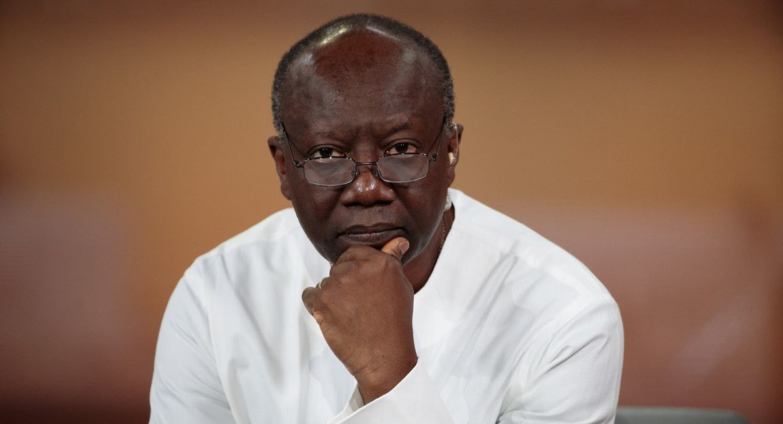

The co-author of dead UT Bank, Ruler Kofi Amoabeng, says he once safeguarded out Back Serve, Insight Ofori-Atta when his trade run into a few budgetary challenges.

In Kofi Amoabeng’s book, “the UT story: Humble Beginnings†he described how Insight Ofori-Atta came to him to borrow ¢5 million to keep his trade above water.

“Insight and his accomplice, Keli Gadzekpo, came to me bearing their offers in Undertaking Protections as collateral for a advance of approximately ¢5 million.

“At the time, the cedi had experienced redenomination and had been rebranded as ‘unused Ghana cedi’. The ¢5 million he asked, in this manner, was comparable to almost $5 million,†he said.He unveiled in his book, that he felt obliged to grant the cash to Insight in spite of it being over the Single Obligor Constrain at that point, due to their fellowship.

At the time, UT was a non-bank budgetary benefit company causing a disturbance in Ghana’s budgetary segment with their superfast advances and obligation recuperation methodology.

“We were exceptionally great companions so I felt obliged, though not without conducting the vital due constancy. It was inquisitive in spite of the fact that that they did not favor the banks where they would have secured the advance at a much lower yearly intrigued rate as compared to our altogether higher month to month compounded intrigued rates. “Be that because it may after I scrutinized their reports. I felt it was worthy to give the credit. The as it were catch, and a critical one at that, was that the sum surpassed the Single Obligor Constrain. In a perfect world, I ought to have declined their ask there and after that. Instep, I chosen to safeguard them out,†he said.

Kofi Amoabeng at that point looked for authorization from his board individuals who contradicted the giving of the advance eagerly.

In his book, Kofi Amoabeng expressed that considering the hardened restriction he confronted from his board individuals, he “actually stood surety for their application†and the board reluctantly allowed the application.

Be that as it may, things did not dish out like he had trusted they would.

“Shockingly, Insight fizzled to respect his conclusion of the deal. He defaulted severely on the repayment plan. The circumstance was so awful that they may as it were benefit the intrigued on the credit,†he uncovered.

“I got to be concerned since I had guaranteed the board I knew Insight exceptionally well and I was persuaded past question that he would respect his word. In this way I had egg on my confront, particularly as my accomplice had explicitly expressed his objection of the ask,†he said.

blogpay

blogpay