Absa Bank has set out to address the most pressing issue confronting Ghana's merchants and small enterprises today: access to capital.

Without a doubt, SMEs account for more than 80% of the country's GDP growth. These companies represent the foundation of economic growth, progress, and stability. Ghana's history and current performance may be traced back to the adventurous ingenuity of its SMEs, particularly micro-traders, craftsmen, and small businesses.

Access to money remains a key obstacle for them, unlike their colleagues at huge institutions, multinationals, and other business settings. When access to financing becomes accessible, the rates are excessively high and extravagant, which discourages people from applying or using it. When it comes to individual loans, the issue becomes more complicated.

The need of collaterals is imposed in order to exclude a segment of these small company owners. Many proponents have advocated for a rethink of the economic system and the removal of obstacles to allow such enterprises to grow. The Ghana Union of Merchants Association (GUTA), which represents the majority of traders and retail enterprises in Ghana, has frequently lamented the lack of flexibility in the financing environment and urged the government and private sector to address the issue.

In this context, Absa Bank Ghana teamed with the Mastercard Foundation to support and educate 5,000 locally-owned businesses with the goal of creating 50,000 employment in Ghana through the Young Africa Works (YAWS) initiative. The strategic relationship between Absa Bank Ghana and the World Bank will last for five years (2020-2025).

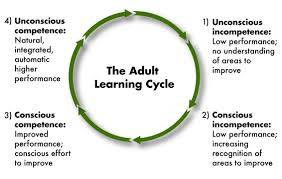

The Mastercard Foundation (MCF) aims to provide young men and women in Ghana with respectable and meaningful careers. MSMEs are also helped by the programme through capacity building, training, and lending. YAWS will assign Business Development Service (BDS) providers to these specific SMEs as part of its capacity-building responsibility to identify gaps in their business processes and provide customised training and solutions to solve them. Following the training, these enterprises would be further evaluated for loan reasons in order to assure their long-term viability.

Absa signed a Memorandum of Understanding (MOU) with the management of GUTA the other day in Accra, in front of over 350 members of GUTA. The MOU outlined the details of the cooperation in great detail, including the financial arrangements.

blogpay

blogpay