In the financial year ended 2021, Access Bank Ghana Plc had a solid growth trajectory across key parameters. Profit before taxes increased by 41 percent from GHS 355 million in 2020 to GHS 501 million in 2021, while overall operating income increased by 28 percent from GHS 567 million in 2020 to GHS 728 million in 2021.

These were announced at the Ghana Stock Exchange's annual "Facts Behind The Figures" event, which was held remotely. The platform allows publicly traded firms to communicate their performance to important stakeholders such as investors and shareholders, as well as receive comments from them.

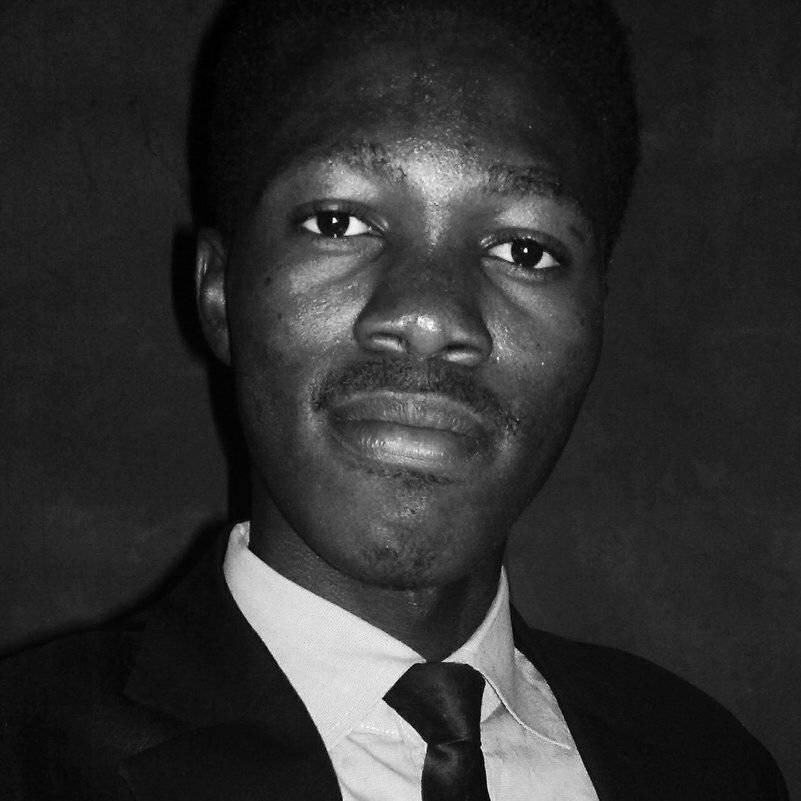

Speaking at the ceremony, Olumide Olatunji, Managing Director of Access Bank Ghana Plc, expressed his delight at the Bank's customers' trust, as indicated by the Bank's considerable increase across key performance measures, and praised the efforts made by all stakeholders in accomplishing the achievement.

"The rise in gross earnings of 28 percent is mostly attributable to an increase in interest income from higher yields as a result of lower cost of funds, which fell from 5.87 percent in 2020 to 4.76 percent in 2021. According to him, the Bank saw a 101 percent growth in net trading revenue from GHS 151 million to GHS 305 million, as well as a 26 percent increase in fee and commission income from GHS 69 million to GHS 87 million, thanks to efficient treasury activities.

Olumide stated that the Bank's vision for 2022 was thoughtful and disciplined, with a focus on strategic expansion and growth. As the world learns to live with Covid-19 and rising inflationary pressures, the Bank is focusing on improving operational efficiency to ensure it is well-positioned to absorb any shocks in a more unpredictable operating environment. By providing best-in-class user experience in retail and consumer banking services, the Bank will continue to invest in bespoke solutions to satisfy the demands of clients. All of this is intended to improve customer happiness and return value to customers," he added.

As part of its retail banking development and wholesale banking consolidation aspirations, Olumide also stated that Access Bank is determined to being a bank of choice in Ghana. "Under our universal gateway strategy, we are optimising payments, remittances, transfers, trade, cross-border, and electronic banking to serve our customers in order to achieve our strategic vision of being the preferred bank in international trade transactions within the African continent and beyond," he said.

blogpay

blogpay