Essential Tax Tips for Singapore Residents: Maximising Savings and Financial Planning

In the bustling city-state of Singapore, where financial management is crucial for survival, tax planning plays a pivotal role in optimising cash flows. Whether you are a high-net-worth individual (HNWI) or a regular tax-paying citizen, understanding the intricacies of Singapore's tax system can lead to substantial savings in the long run. Let's explore some fundamental tips to help reduce your tax burden and make informed financial decisions.

1. Claim Applicable Tax Reliefs and rebates.

Singapore's progressive tax rates, ranging from 0% to 22% for annual incomes exceeding S$320,000 (YA 2018), offer several opportunities for tax relief. Various concessions are available to support contributions in areas aligned with the government's policies, such as parenthood, family formation, aged care, skills upgrading, and national service. Make sure to claim relevant reliefs like spouse relief, child relief, parent relief, earned income relief, and foreign maid levy relief, among others, to optimise your tax savings.

2. Top up Your CPF (Central Provident Fund).

The CPF Minimum Sum Topping-Up Scheme allows you to claim tax relief when topping up your CPF savings. Whether you or your employer make the top-up, you can enjoy the tax benefits. Additional relief can be claimed for top-ups made to the CPF of family members, subject to certain conditions. The maximum CPF top-up relief you can claim per year is S$14,000.

3. Contribute to the SRS (Supplementary Retirement Scheme).

The Supplementary Retirement Scheme (SRS) encourages individuals to save for retirement beyond their CPF savings. Contributions to SRS are eligible for tax relief, reducing your chargeable income. Investment returns within the SRS account are tax-free until withdrawal, and only 50% of withdrawals at retirement are taxable. The maximum contribution allowed for Singaporeans and Permanent Residents is S$15,300 per year (YA 2018), while foreign work visa holders have a cap of S$35,700.

4. Voluntarily Contribute to Your Medisave Account

Contributions made to your Medisave Account come with tax relief, reducing the taxes you need to pay while saving up for healthcare needs. The amount of relief allowed for voluntary Medisave contributions is limited, depending on various factors like voluntary contributions made specifically to the account and annual CPF limits.

5. Make Charitable donations.

Donations made to approved Institutions of Public Character (IPC) or Qualifying Grant-making Philanthropic Organisations are tax-deductible. Depending on the type of donation, you may claim a double tax deduction, which allows you to deduct twice the amount of the donation. Making charitable donations not only serves a noble cause but also provides substantial tax savings.

6. Consider the Not Ordinarily Resident (NOR) Scheme

Under the Not Ordinarily Resident (NOR) scheme, qualified individuals can enjoy tax benefits for up to 5 years of assessment (YA). To qualify, you must meet specific criteria, including not being in Singapore for three YAs prior to the year you apply for the NOR scheme and being a tax resident for the YA in which you wish to qualify for NOR status.

7. Deduct Rental Expenses from Rental income.

If you earn rental income, you can deduct associated expenses to reduce your taxable income. Examples of deductible expenses include property tax, mortgage interest, insurance, maintenance fees, and general repairs. Ensure that these expenses are incurred solely for the purpose of generating rental income during the period of tenancy.

Remember that these tips provide general guidance for reducing your Singapore income tax burden. For personalised tax planning, especially if your tax situation is unique, it is wise to consult a Singapore tax specialist.

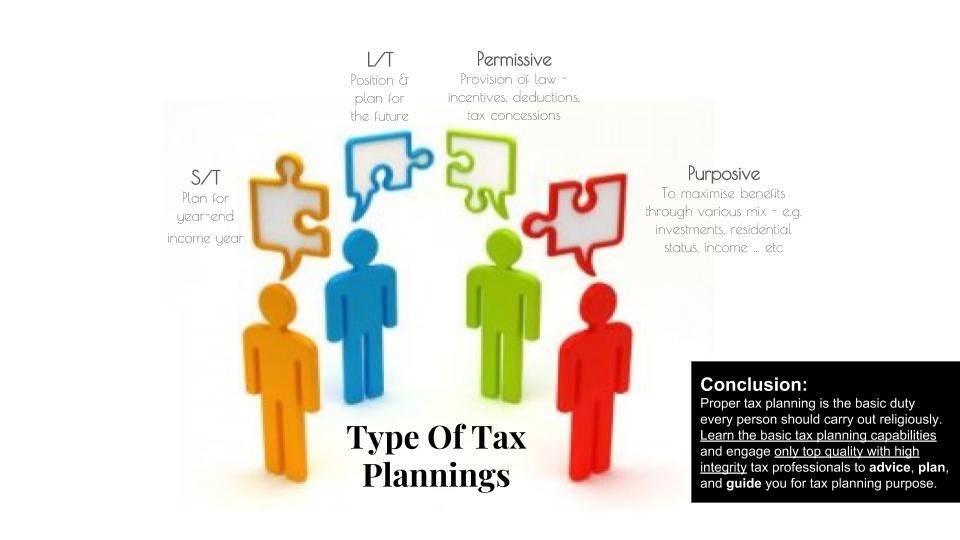

In conclusion, being proactive in your tax planning can lead to significant savings and a well-structured financial strategy. By understanding and leveraging the tax reliefs and schemes available in Singapore, you can optimise your cash flows and work towards a financially secure future.

Whether you are a high-income earner or an average taxpayer, implementing these tax tips will empower you to make informed financial decisions and embrace a more financially stable future.

Taking control of your tax strategy is essential for financial success, especially in a city as economically dynamic as Singapore. With proper tax planning, you can unlock the potential for better cash flow positioning, enabling you to navigate the challenges of living in one of the world's most expensive cities.

Regardless of your income level, tax planning is a necessity for all tax-resident individuals. It directly impacts your disposable income and can lead to substantial long-term savings. By maximising available tax relief and rebates, you can effectively reduce your tax burden, allowing for more efficient financial management.

When planning your taxes, it's crucial to stay informed about changes in tax regulations and policies. The government may introduce new incentives or modify existing ones to align with economic conditions and social objectives. By keeping abreast of these updates, you can adapt your tax strategy to maximise benefits and minimise liabilities.

Utilising tax-advantaged investment options is another effective way to optimise your financial planning. The Central Provident Fund (CPF) and Supplementary Retirement Scheme (SRS) offer tax benefits while providing avenues for retirement savings. By taking advantage of these programmes, you can ensure a secure financial future while reducing your taxable income.

Moreover, contributions to your Medisave Account not only offer tax relief but also safeguard your healthcare needs. With rising medical costs, having adequate healthcare savings is essential for your well-being. Voluntarily contributing to your Medisave Account allows you to simultaneously protect your health and reduce your tax obligations.

Engaging in charitable giving not only fulfils your philanthropic aspirations but also provides tax benefits. Donations to approved charitable organisations can qualify for double tax deductions, offering a powerful incentive for supporting worthy causes. By contributing to society, you can create a positive impact while enjoying significant tax savings.

The Not Ordinarily Resident (NOR) scheme provides a unique opportunity for eligible individuals to enjoy tax benefits for a specified period. For those who meet the NOR criteria, this scheme offers a strategic advantage for tax planning during the designated years of assessment.

If you earn rental income, take advantage of deductible expenses to optimise your taxable income. Properly accounting for rental-related costs such as property tax, mortgage interest, and maintenance fees can reduce your tax liability while preserving your rental income.

While these general tips can help reduce your tax burden, it's essential to recognise that each individual's financial situation is unique. Consulting a tax specialist in Singapore can provide personalised guidance tailored to your specific needs and circumstances. A tax professional can help you navigate complex tax regulations and design a comprehensive tax strategy aligned with your financial goals.

As Singapore's economic landscape continues to evolve, staying proactive in your financial planning is crucial for sustained growth and prosperity. By embracing smart tax planning, you can optimise your financial position, seize opportunities, and build a strong foundation for a successful financial future.

In conclusion, proactive tax planning is the key to unlocking financial success in Singapore. By exploring the available tax reliefs, optimising your CPF and SRS contributions, and engaging in strategic financial practises, you can maximise savings and enhance your financial well-being. Whether you are an individual taxpayer or an aspiring entrepreneur, understanding the intricacies of Singapore's tax system and seeking expert advice will empower you to navigate the complexities of financial management successfully. Embrace the power of tax planning to secure a prosperous future and realise your financial aspirations in this vibrant city-state.

No comments yet

Be the first to share your thoughts!