How the 10% tax on betting will be deducted.

15th August, 2023.

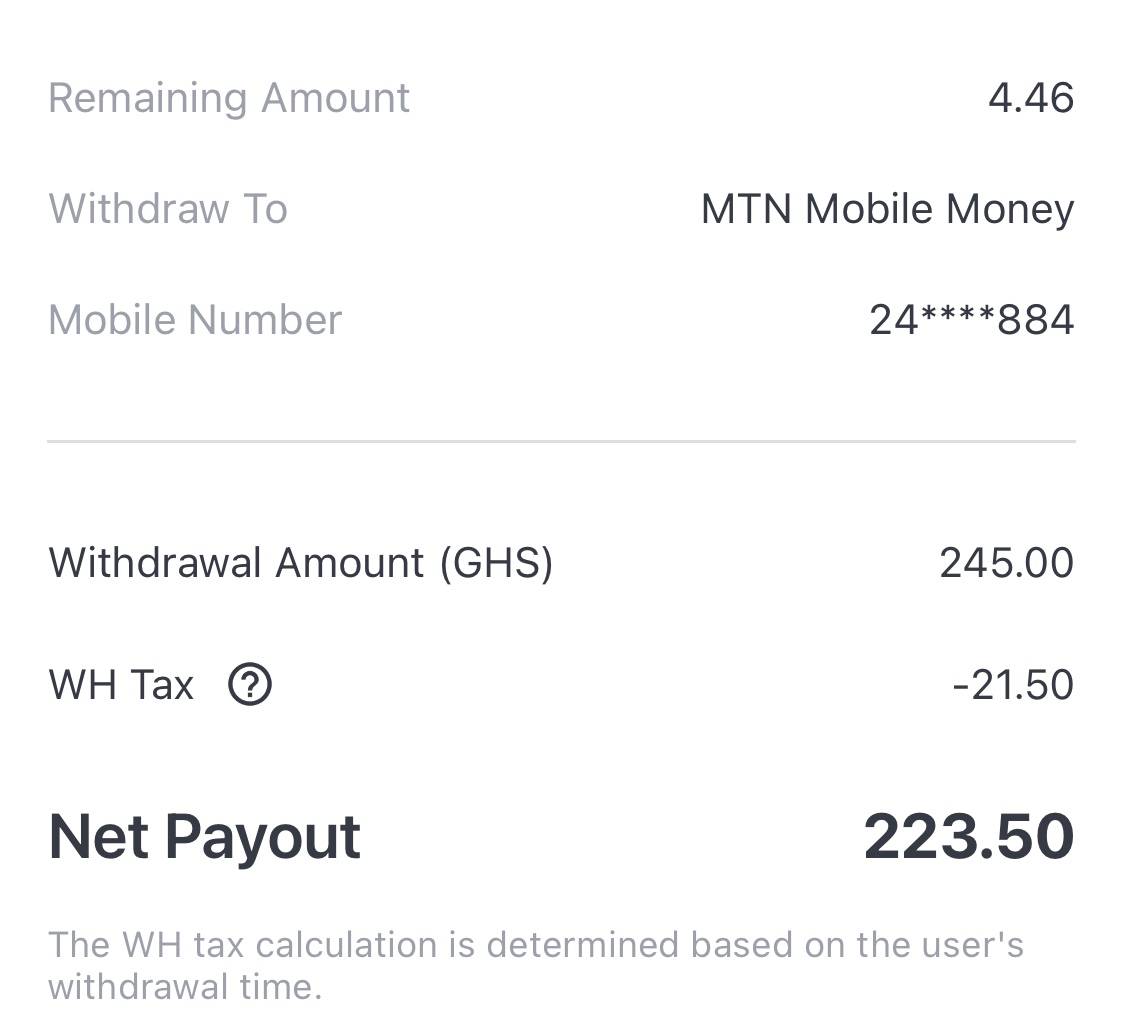

As a means to bolster government revenue for development purposes, a 10% withholding tax on betting and lottery winnings has been introduced, effective from Tuesday, August 15, 2023.

This new tax policy specifically targets the profits earned from betting and lottery activities, exempting the initial amount invested in staking or participating in the games. For instance, if someone deposited ¢10,000 on August 15, 2023, and subsequently won ¢50,000, the tax would be levied on the profit, which is ¢40,000.

The deduction of the 10% tax will occur during the withdrawal of winnings. For example, if the full ¢50,000 is withdrawn, ¢4,000 will be deducted as tax.

To delve more into the concern,

However, a concern arises regarding instances where some betting users are being taxed even though they deposited funds before the implementation date and didn't use those funds for betting. This has led to deductions on their initial capital, causing dissatisfaction among these users.

The decision to impose such a tax was met with criticism, particularly from the younger population engaged in sports betting, who expressed their dissatisfaction on social media platforms. The betting industry in Ghana has experienced significant growth in recent years, attracting several betting companies to establish a presence in the country.

The issue of sports betting has been a subject of debate in Ghana, with some highlighting its impact on the youth, while others argue that as long as it is legal and adheres to regulations, it should not be deemed inherently negative.

This development aligns with the enactment of the Income Tax (Amendment) Act, 2023 (Act 1094), which mandates the withholding tax on lottery wins. The tax is deducted by the lottery operators and remitted to the Ghana Revenue Authority (GRA). The scope of the tax covers various sectors, including sports betting, casino operations, marketing promotions, and national lotto betting, among others.

No comments yet

Be the first to share your thoughts!