Education is a key investment in any student's future, but the cost of tuition and other educational expenses can often be a significant hurdle. Fortunately, students in Ghana have access to financial assistance through the Student Loan Trust Fund (SLTF), designed to support students in tertiary institutions across the country. In this article, we’ll guide you through the steps on how to apply for a student loan in Ghana using the SLTF, and outline the requirements needed to qualify.

What is the Student Loan Trust Fund (SLTF)?

The Student Loan Trust Fund was established by the Government of Ghana to provide loans to students in accredited tertiary institutions. The loan helps students cover costs such as tuition fees, accommodation, books, and living expenses. Repayment of the loan begins after graduation, giving students ample time to focus on their studies.

Eligibility Requirements

Before applying for the student loan, it’s important to ensure that you meet the necessary eligibility criteria. Below are the key requirements:

1. Ghanaian Citizenship

You must be a Ghanaian citizen with a valid Ghana Card.

2. Enrollment in an Accredited Tertiary Institution

You must be a full-time student enrolled in a recognized public or private accredited tertiary institution, such as a university, polytechnic, or college of education.

3. Admission Status

You must have been officially admitted into a tertiary institution and should have completed your registration for the academic year.

4. Valid Social Security Number (SSNIT) / Ghana card

You must be a contributor to the Social Security and National Insurance Trust (SSNIT), or your legal guardian or sponsor must be a contributor. If you don’t have a SSNIT number, you’ll need to register for one before applying for the loan.

5. Valid E-Zwich Card

This is necessary for the disbursement of funds. You’ll need to provide your E-Zwich card details during the application process.

6. Guarantor

To secure the loan, you will need a guarantor who must also meet certain qualifications (explained further below).

How to Apply for a Student Loan in Ghana

Here’s a step-by-step guide to applying for a student loan through the SLTF:

Step 1: Register for an E-Zwich Card

Visit any bank or financial institution that offers E-Zwich services to obtain an E-Zwich card. This card is essential as it will be used for all loan disbursements.

Step 2: SSNIT Registration

Ensure that you or your guarantor is a registered contributor to the SSNIT. If not, visit the nearest SSNIT office to register. You will be issued a SSNIT number, which is required for your loan application.

Step 3: Gather Required Documents

To complete your application, you’ll need the following documents:

- A Ghana Card for identification.

- Your Admission Letter from your tertiary institution.

- Your Student ID issued by the school.

- E-Zwich Card details.

- Your SSNIT Number or that of your guarantor.

Step 4: Find a Guarantor

You will need a guarantor to support your application. Acceptable guarantors include:

- SSNIT contributors with at least 5 years of contributions.

- A Metropolitan, Municipal, or District Assembly (MMDA) official.

- A religious leader.

- A corporate body.

The guarantor will be responsible for ensuring the repayment of the loan if you default, so they should be trustworthy.

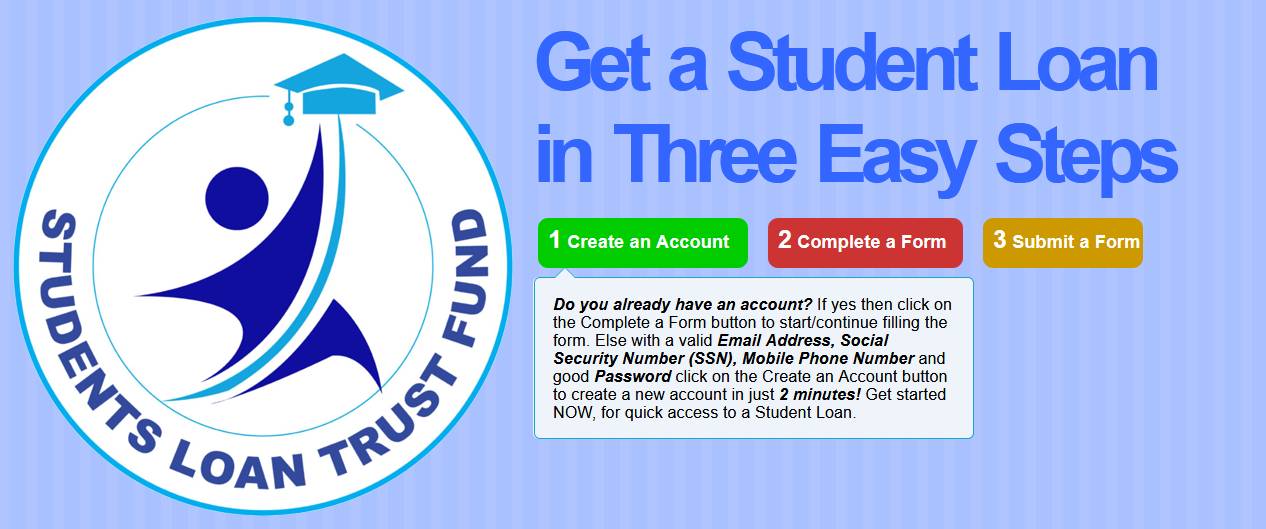

Step 5: Complete the Online Application

1. Visit the SLTF website:

2. Create an Account: Register with your personal details, SSNIT number, and E-Zwich card information.

3. Fill in the Application Form: Provide all the necessary details, including your guarantor’s information.

4. Upload Required Documents: Attach scanned copies of your Ghana Card, admission letter, student ID, and other necessary documents.

5. Submit Application: After reviewing your application, submit it online.

Step 6: Loan Disbursement

Once your application is approved, the loan amount will be disbursed directly into your E-Zwich account. Disbursements are usually done in tranches throughout the academic year to cover your expenses as needed.

Repayment of the Loan

Repayment of the SLTF loan begins after completion of your course. You are given a grace period of one year to find employment before repayment starts. The repayment period is flexible and can be made through SSNIT deductions or monthly payments through E-Zwich or direct bank deposits.

If you have trouble repaying the loan, the SLTF offers options such as loan restructuring to make it easier for you to manage your payments.

Key Points to Note

- The SLTF loan is interest-bearing, meaning that you will be required to pay a small amount of interest along with the principal loan.

- You can reapply for the loan each academic year if you need additional financial assistance.

- Be mindful of repayment obligations after graduation to avoid penalties or legal issues.

Conclusion

Applying for a student loan through the Student Loan Trust Fund is a great way to finance your education and ease the financial burden while focusing on your studies. Ensure that you meet the eligibility criteria, gather the required documents, and follow the application steps carefully. With the right planning and understanding of the process, securing a student loan in Ghana has never been easier.

For more details and updates on loan disbursement, you can always visit the official SLTF website or contact their customer service center.

Belinda Osei Amoako

May 24, 2025I want student loan