It may be stressful to budget, primarily if you have no idea on how to divide your income properly. That is why the 50/30/20 rule is important – a concept that can help you optimize your flow of money and guarantee that you are spending, saving and investing, effectively. If you are a beginner at budgeting and want to become a professional in this sphere this rule can be very helpful.

What is the 50/30/20 Rule?

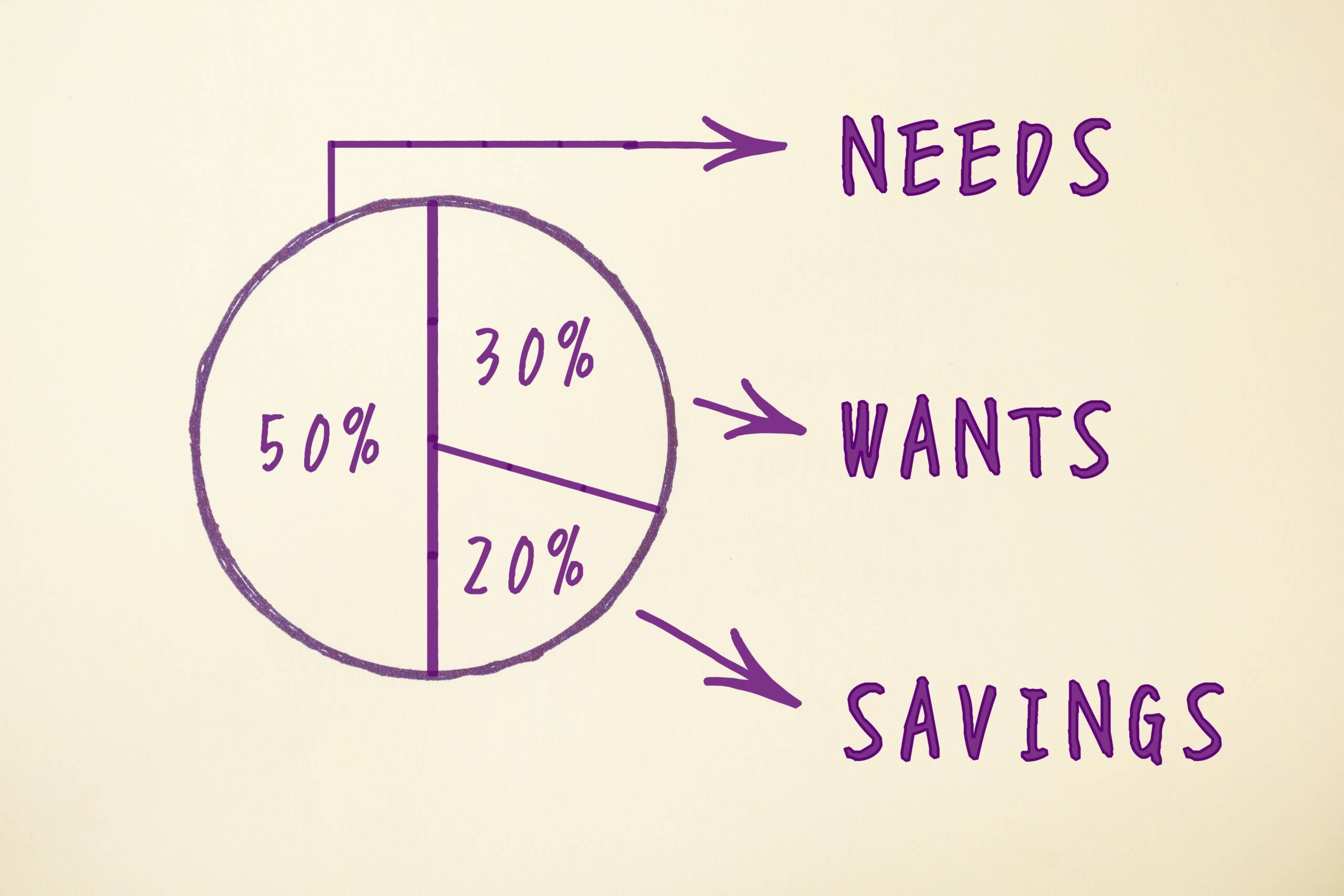

The 50/30/20 rule is a quite simple plan for budgeting your after-tax income into three broad categories:

- 50% for Needs

- 30% for Wants

- 20% for Savings and Debt Repayment

They recommended this structure because it balances out your money and gives you room to spend money for both the necessities and the funds.

1. 50% for Needs

The first sixty percent of your budget should be devoted to necessities—those things that are absolutely vital in any household. Some of these cost include; shelter costs that include rent or mortgage, energies, water and gas, food and Sudan nonalcoholic beverages, transportation, personal insurances and minimum amounts payable on interest expenses. In simple words, anything that is essential in the lives of people falls in this category.

For it to work it’s important that one must learn to differentiate between needs and wants. Another weakness is considering dining out or owning the latest gadgets as needs when in fact they are under wants. Always have to maintain a minimum needs list and do not indulge too much on wants.

2. 30% for Wants

The next thirty percent of living is provided for in the category referred to as wants. This is exactly where you stand free to spend on things that add value to your standard of living but are not necessarily basic needs. Some wants include; eating out, fun, recreation, travel, and other unnecessary purchases.

Only when you set us some money for wants you can indulge yourself in life without regretting for spending money on them. Although, it is advisable to go for the low house price and ensure that one does not cross this limit a when selecting a house. If you find yourself short of cash at any one time, this is the easiest category to cut down sometimes.

3. 20% for Savings and Debt Repayment

Depositing and paying off, the saving should not exceed 20% of the total income. This category is the most crucial as far as establishment of long term personal financial reserves are concerned. If you have high-interest debt, the first thing you should do is to eliminate it. After paying off the debt it is advised to begin saving for emergencies and making contributions towards saving and investing in a retirement plan.

At least make this process automated by having a transfer in a ‘savings account or retirement fund’ each time you are paid. When you continue to save, you will ensure that your financial future is well taken care of, as well as your needs and wants that you have right now.

How to Apply the 50/30/20 Rule

- Calculate your after-tax income: This is the money you take home after tax, insurance, and retirement benefits deductions have been made.

- Categorize your expenses: Divide your expenditure throughout a particular month into the required, desired and necessary forms of expenditure.

- Make adjustments: If it is over half of your income, then means it is high time that you changed your life style by for instance, looking for even cheaper houses that you could rent or use less electricity in the house. The same applies if your wants category is too high, then you should try and look for areas where you can cut down on the expenses.

- Stick to the plan: It is for this reason that 50/30/20 rule is effective when you go for it. The last action is monitoring your budgets and make sure that spending is on the right track and make changes if necessary.

Conclusion

The 50/30/20 rule can be considered one of the most efficient as a strategy for the effective distribution of money because it can provide for all the needs, satisfy minor desires and save money. By sticking to this rule you can be on top of your money, manage stress and build a healthy financial foundation for your future. Begin your journey to being a professional budgeter today and see how quickly those financial goals are within reach!

No comments yet

Be the first to share your thoughts!