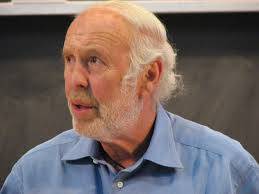

Jim Simons: The Mathematical Genius Behind Renaissance Technologies

James “Jim†Simons, born on April 25, 1938, in Newton, Massachusetts, is a former mathematician turned billionaire hedge fund manager, known as the founder of Renaissance Technologies. Simons is regarded as one of the most successful hedge fund managers in history, pioneering the use of quantitative trading, or applying mathematical models and data analysis to predict market movements. His hedge fund, Renaissance Technologies, is particularly famous for its flagship Medallion Fund, which has generated extraordinary returns for its investors for decades.

Beyond his career in finance, Simons is also a prominent philanthropist, supporting scientific research, education, and autism-related causes. His journey from a mathematics professor to a financial icon showcases a rare blend of intellectual brilliance and business acumen.

Early Life and Academic Career

Jim Simons displayed exceptional mathematical ability from an early age. He earned his undergraduate degree in mathematics from the Massachusetts Institute of Technology (MIT) in 1958 and went on to complete his PhD in mathematics at the University of California, Berkeley in 1961, at the age of 23. His dissertation focused on differential geometry, a field that would later play a significant role in his financial career.

Simons initially pursued an academic career, becoming a professor of mathematics at MIT and later at Harvard. His most significant contributions during this time were in the field of geometry, particularly in the development of the Chern-Simons theory, which has had far-reaching implications in both mathematics and theoretical physics. This work earned Simons recognition as one of the leading mathematicians of his generation.

In the late 1960s, Simons left academia briefly to work for the U.S. Department of Defense’s Institute for Defense Analyses, where he contributed to code-breaking and cryptography efforts during the Vietnam War. However, he resigned from his position after publicly opposing the U.S. involvement in the war. This marked a turning point in Simons’ career, as he gradually shifted his focus from mathematics to finance.

Founding Renaissance Technologies

In 1982, Jim Simons founded Renaissance Technologies, a quantitative hedge fund based in Long Island, New York. Renaissance was groundbreaking in its approach, as it relied on mathematical models and algorithms to guide its trading strategies. Simons and his team of scientists, mathematicians, and data analysts sought to find hidden patterns in large sets of historical market data, using statistical techniques to predict future price movements.

At a time when most hedge funds relied on traditional methods such as fundamental analysis, Renaissance’s approach was revolutionary. Simons’ deep understanding of mathematics and pattern recognition allowed him to see opportunities in the market that others missed.

The firm’s most famous fund, the Medallion Fund, launched in 1988, became one of the most successful in history. The Medallion Fund’s performance is legendary, achieving average annual returns of more than 66% before fees over a 30-year period. Even after fees, which are famously high at 5% of assets and 44% of profits, the fund’s net returns have consistently outpaced the broader market.

The Medallion Fund is notable for its secrecy. Renaissance Technologies is extremely guarded about its proprietary algorithms and trading strategies, which rely on sophisticated machine learning and data analysis techniques. The firm has built a reputation for hiring top talent from fields such as physics, mathematics, and computer science rather than traditional finance.

Simons’ Legacy in Quantitative Finance

Jim Simons is often called the “quant king†or the “father of quantitative finance†because of his role in revolutionizing the hedge fund industry. He proved that sophisticated mathematical models could outperform human judgment in the financial markets, and his success has inspired a new generation of quantitative hedge funds that use similar techniques.

Renaissance Technologies’ success has spawned a larger movement toward quant-driven investing, and Simons’ approach has been emulated by firms like Two Sigma, D.E. Shaw, and others. However, the Medallion Fund remains in a league of its own, and its consistent performance is unparalleled in the industry.

In 2009, Simons retired from day-to-day operations at Renaissance Technologies, handing over the reins to his long-time colleagues Peter Brown and Robert Mercer. However, Simons remains involved as chairman of the firm, and his influence on its culture and strategy continues to be significant.

Philanthropy and the Simons Foundation

Jim Simons is as well-known for his philanthropy as he is for his financial success. Through the Simons Foundation, which he co-founded with his wife, Marilyn Simons, he has donated billions of dollars to support scientific research, mathematics, and education. The Simons Foundation is one of the largest private funders of scientific research in the world.

A major focus of the foundation is basic science, particularly in the fields of mathematics, theoretical physics, and biology. The foundation has provided substantial funding for research into autism, computational neuroscience, and cosmology. The Simons Foundation Autism Research Initiative (SFARI) is one of the largest private funders of research into autism spectrum disorders, reflecting Simons’ personal interest in the cause.

In addition to scientific research, Simons has been a strong supporter of mathematics education. He has endowed numerous professorships and fellowships in mathematics and related fields at institutions such as Stony Brook University, MIT, and UC Berkeley. The Simons Foundation also supports Math for America, an organization aimed at improving math education in U.S. public schools.

Personal Life and Interests

Jim Simons is known for his modest and unassuming demeanor, despite his immense wealth and influence. He and his wife, Marilyn, have five children, including one son who was diagnosed with autism, which has been a driving force behind their support for autism research.

Simons enjoys sailing and is an avid philanthropist who continues to push the boundaries of scientific and mathematical research through his foundation. Despite his retirement from Renaissance Technologies, he remains intellectually active, and his contributions to both the financial and scientific worlds continue to shape industries.

Conclusion

Jim Simons’ legacy is defined by his unique combination of mathematical genius and financial acumen. As the founder of Renaissance Technologies, he pioneered quantitative finance and achieved unprecedented success with the Medallion Fund. His contributions to mathematics, combined with his philanthropic efforts through the Simons Foundation, have had a lasting impact on both the financial markets and the scientific community.

Simons’ ability to merge abstract mathematical theories with real-world applications in finance has set him apart as one of the most influential figures of modern finance, and his commitment to philanthropy ensures that his legacy will extend far beyond the financial world.

No comments yet

Be the first to share your thoughts!