Why You Should Go in for Forex Trading

In today's fast-paced global economy, individuals are constantly searching for opportunities to grow their wealth and secure financial freedom. Among the many investment options available, foreign exchange (forex) trading stands out as one of the most accessible, liquid, and potentially profitable markets. For both novice and seasoned traders, the allure of forex trading is compelling for several reasons. Below are key factors that highlight why you should consider venturing into the world of forex trading.

1. High Liquidity

Forex is the largest financial market in the world, with a daily trading volume exceeding $6 trillion. The immense size of the forex market ensures high liquidity, which means that trades can be executed quickly and efficiently without significant price fluctuations. This liquidity reduces the risk of price manipulation and slippage, which are common issues in less liquid markets.

2. 24-Hour Market

Unlike stock markets that operate within specific hours, the forex market is open 24 hours a day, five days a week. This allows traders to engage in trading across different time zones—from Sydney to Tokyo, London, and New York. The continuous availability of the market means that traders can respond to news events or market trends almost instantly, offering greater flexibility, especially for those who may want to trade part-time.

3. Leverage Opportunities

One of the most attractive features of forex trading is the ability to use leverage. Leverage allows traders to control larger positions with a relatively small amount of capital. For example, with a leverage ratio of 50:1, a trader with $1,000 can control $50,000 worth of currency. While leverage can magnify profits, it is essential to approach it with caution, as it can also increase losses. Nevertheless, for those who manage risk carefully, leverage is a powerful tool that amplifies trading potential.

4. Low Transaction Costs

Forex trading typically involves low transaction costs, especially in comparison to other financial markets like equities or futures. Most forex brokers charge very low commissions, with some offering commission-free trading. Instead, the cost of trading is usually reflected in the bid-ask spread, which in liquid currency pairs like EUR/USD, can be as narrow as a few pips. This makes it cost-effective for traders to enter and exit positions frequently.

5. Diverse Trading Options

The forex market offers a vast array of currency pairs to trade, allowing participants to take advantage of global economic trends and geopolitical events. Major pairs, such as EUR/USD and GBP/USD, are popular for their liquidity and volatility, while minor and exotic pairs provide opportunities for those looking for more unique trading strategies. Additionally, traders can hedge positions by taking advantage of the interrelationships between different currencies, offering more flexibility in portfolio management.

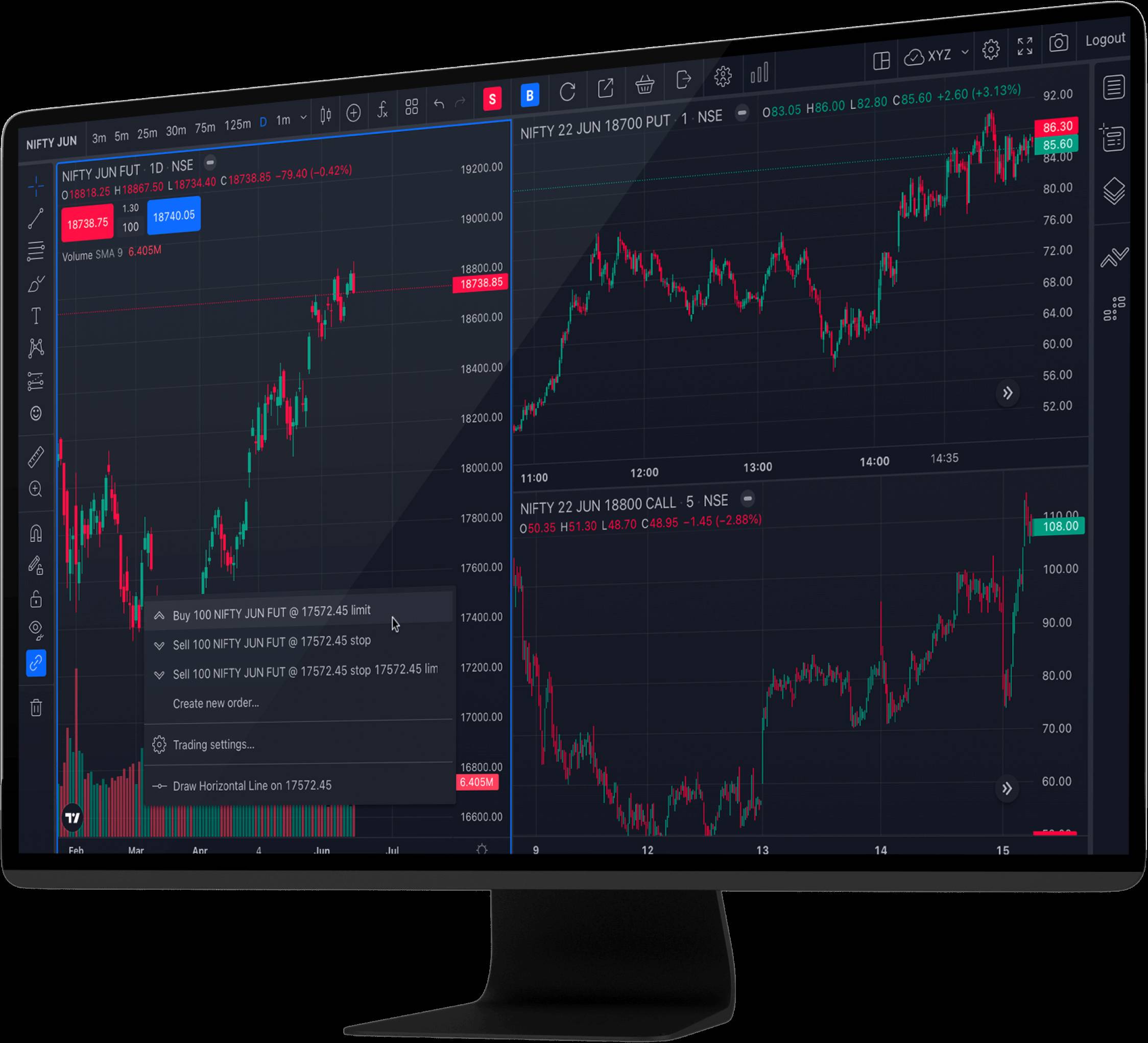

6. Accessibility and Technological Advancements

Advances in technology have made forex trading highly accessible. Thanks to online trading platforms, even individuals with minimal experience can enter the market. Most platforms come equipped with user-friendly interfaces, educational tools, and demo accounts that allow beginners to practice trading without risking real money. Moreover, sophisticated analytical tools, automated trading systems, and mobile apps enable traders to stay connected and informed on the go.

7. Global Economic Influence

Engaging in forex trading not only provides financial opportunities but also increases your awareness of global economics. Since the value of currencies is driven by macroeconomic factors such as interest rates, inflation, and geopolitical events, traders often stay updated on economic news and policy decisions. This knowledge can enhance one's understanding of global financial systems, making forex trading a valuable educational experience as well.

8. Potential for Profit in Both Rising and Falling Markets

In forex trading, there is the unique opportunity to profit in both rising and falling markets. Since traders are always dealing with currency pairs, a trade involves simultaneously buying one currency and selling another. If a trader believes a currency will depreciate, they can go short (sell) that currency while buying another, thus profiting from the anticipated decline. This flexibility allows for trading strategies that work in various market conditions, unlike stock markets where short-selling can be more complex and restricted.

9. No Centralized Exchange

The decentralized nature of forex trading ensures that no single institution or entity has absolute control over the market. This decentralization fosters greater competition among brokers, which in turn benefits traders by offering tighter spreads, better execution speeds, and enhanced transparency. Unlike stock markets, where an exchange can dictate certain rules or fees, forex is more market-driven, with prices reflecting real-time supply and demand dynamics.

10. Ideal for Portfolio Diversification

Forex trading can serve as an excellent addition to an investment portfolio. While traditional portfolios may include stocks, bonds, and real estate, incorporating forex allows investors to diversify their assets across different financial instruments. Since currency values are influenced by various global factors, forex can act as a hedge against potential downturns in other asset classes, providing a more balanced and resilient portfolio.

Conclusion

Forex trading offers a multitude of benefits for those willing to dive into this dynamic and exciting market. Whether you’re attracted by the market’s liquidity, the potential for high returns, or the flexibility to trade on your schedule, forex provides an ideal avenue for investors looking to grow their wealth. However, as with any form of trading, it's crucial to approach forex with a solid understanding of risk management and to continue learning to refine your strategies. With the right approach, forex trading can become a rewarding financial endeavor.