*MetaEarn: Unlocking Financial Freedom through Digital Earnings*

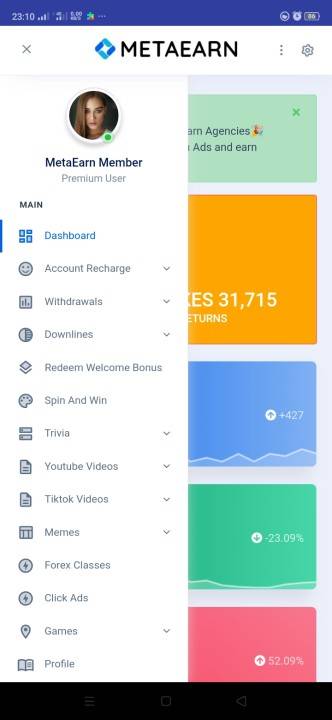

MetaEarn is a revolutionary platform empowering individuals to achieve financial independence through digital earnings. This innovative system combines cutting-edge technology with expert financial strategies, providing users with a comprehensive toolkit to manage and grow their wealth.

*Key Features:*

1. *Digital Income Streams*: MetaEarn offers diverse revenue sources, including freelance work, online trading, and cryptocurrency investments.

2. *Financial Education*: Expert-led webinars, tutorials, and resources to enhance financial literacy and smart investing.

3. *Automated Investment*: AI-driven portfolio management and dividend reinvestment for optimized returns.

4. *Community Support*: Networking opportunities with like-minded individuals and expert mentors.

5. *Reward System*: Incentives and bonuses for achieving financial milestones.

*Benefits:*

1. *Passive Income*: Generate consistent revenue without direct involvement.

2. *Financial Security*: Diversify investments and reduce risk.

3. *Personal Growth*: Develop valuable skills and financial acumen.

4. *Flexibility*: Accessible online, anytime, anywhere.

*Getting Started:*

1. Sign up on the MetaEarn platform.

2. Complete financial profile and risk assessment.

3. Explore income streams and investment options.

4. Engage with community and expert resources.

*Conclusion:*

MetaEarn revolutionizes the way people achieve financial freedom. By leveraging digital earnings, expert knowledge, and community support, individuals can break free from financial constraints and build a prosperous future.

*Join the MetaEarn movement today and unlock your financial potential!*

Would you like more information on MetaEarn or financial freedom strategies?

MetaEarn, as a digital earnings platform, prioritizes transparency and compliance regarding tax implications. Here's an overview of how MetaEarn handles taxes:

*Tax Compliance*

1. User Reporting: MetaEarn provides detailed, downloadable reports on earnings, dividends, and transactions for tax purposes.

2. Tax Forms: Issues necessary tax forms (e.g., 1099-MISC, K-1) to users and relevant authorities.

3. Tax Withholding: Automatically withholds applicable taxes on earnings, ensuring compliance.

*Tax Optimization*

1. Expert Guidance: Offers access to certified tax professionals for personalized advice.

2. Tax-Efficient Strategies: Provides educational resources on minimizing tax liabilities.

3. Investment Optimization: AI-driven investment algorithms consider tax implications.

*Integration with Tax Authorities*

1. API Connections: Seamlessly integrates with tax authority systems for efficient reporting.

2. Automatic Filings: Submits required tax documentation on behalf of users.

*User Responsibilities*

1. Tax Obligations: Users remain responsible for reporting and paying taxes on earnings.

2. Accuracy: Ensure accuracy of tax information and reporting.

*MetaEarn's Tax Policy*

1. Transparency: Clearly outlines tax policies and procedures.

2. Compliance: Adheres to relevant tax laws and regulations.

3. Cooperation: Collaborates with tax authorities to ensure compliance.

*Regional Tax Considerations*

MetaEarn accommodates regional tax differences, including:

1. Value-Added Tax (VAT)

2. Goods and Services Tax (GST)

3. Regional income tax rates

*Future Developments*

MetaEarn continuously updates its tax handling to accommodate evolving tax regulations and user needs.

*Additional Resources*

For more information, users can access:

1. MetaEarn's Tax FAQ section

2. Tax Education Center

3. Customer Support

By prioritizing tax compliance and optimization, MetaEarn empowers users to manage their digital earnings with confidence.

Would you like more information on MetaEarn's tax handling or tax strategies?

Here's more information on MetaEarn's tax handling:

*MetaEarn Tax Features*

1. Automated Tax Calculations

2. Real-time Tax Estimates

3. Detailed Tax Reports

4. Tax Form Generation (1099-MISC, K-1, etc.)

5. Integration with Tax Software (TurboTax, QuickBooks, etc.)

*Tax Implications for MetaEarn Activities*

1. Freelance Work: Self-employment taxes, business expense deductions

2. Online Trading: Capital gains taxes, wash sale rule implications

3. Cryptocurrency Investments: Capital gains taxes, IRS guidance compliance

*Regional Tax Considerations*

1. US Tax Law: Compliance with IRS regulations

2. EU Tax Law: VAT, GDPR considerations

3. Asia-Pacific Tax Law: Country-specific regulations (e.g., Australia, Japan)

*MetaEarn Tax Partnerships*

1. Tax Preparation Services (e.g., H&R Block)

2. Accounting Software Providers (e.g., Xero)

3. Tax Consultation Services (e.g., Ernst & Young)

*User Tax Obligations*

1. Reporting Earnings: Accurate tax reporting

2. Paying Taxes: Timely tax payments

3. Maintaining Records: Keeping accurate financial records

*MetaEarn Tax Education*

1. Tax Webinars

2. Tax Blog

3. Tax FAQ Section

4. Tax Calculator Tools

*Future Tax Developments*

1. AI-driven Tax Optimization

2. Blockchain-based Tax Reporting

3. Integration with Emerging Tax Technologies

Stay informed about MetaEarn's tax handling and updates through their official blog, social media, or customer support.

Would you like more information on a specific aspect of MetaEarn's tax handling?

Here's more information on MetaEarn's tax handling:

*MetaEarn Tax Features*

1. Automated Tax Calculations

2. Real-time Tax Estimates

3. Detailed Tax Reports

4. Tax Form Generation (1099-MISC, K-1, etc.)

5. Integration with Tax Software (TurboTax, QuickBooks, etc.)

*Tax Implications for MetaEarn Activities*

1. Freelance Work: Self-employment taxes, business expense deductions

2. Online Trading: Capital gains taxes, wash sale rule implications

3. Cryptocurrency Investments: Capital gains taxes, IRS guidance compliance

*Regional Tax Considerations*

1. US Tax Law: Compliance with IRS regulations

2. EU Tax Law: VAT, GDPR considerations

3. Asia-Pacific Tax Law: Country-specific regulations (e.g., Australia, Japan)

*MetaEarn Tax Partnerships*

1. Tax Preparation Services (e.g., H&R Block)

2. Accounting Software Providers (e.g., Xero)

3. Tax Consultation Services (e.g., Ernst & Young)

*User Tax Obligations*

1. Reporting Earnings: Accurate tax reporting

2. Paying Taxes: Timely tax payments

3. Maintaining Records: Keeping accurate financial records

*MetaEarn Tax Education*

1. Tax Webinars

2. Tax Blog

3. Tax FAQ Section

4. Tax Calculator Tools

*Future Tax Developments*

1. AI-driven Tax Optimization

2. Blockchain-based Tax Reporting

3. Integration with Emerging Tax Technologies

Stay informed about MetaEarn's tax handling and updates through their official blog, social media, or customer support.

Would you like more information on a specific aspect of MetaEarn's tax handling?MetaEarn, as a digital earnings platform, prioritizes transparency and compliance regarding tax implications. Here's an overview of how MetaEarn handles taxes:

*Tax Compliance*

1. User Reporting: MetaEarn provides detailed, downloadable reports on earnings, dividends, and transactions for tax purposes.

2. Tax Forms: Issues necessary tax forms (e.g., 1099-MISC, K-1) to users and relevant authorities.

3. Tax Withholding: Automatically withholds applicable taxes on earnings, ensuring compliance.

*Tax Optimization*

1. Expert Guidance: Offers access to certified tax professionals for personalized advice.

2. Tax-Efficient Strategies: Provides educational resources on minimizing tax liabilities.

3. Investment Optimization: AI-driven investment algorithms consider tax implications.

*Integration with Tax Authorities*

1. API Connections: Seamlessly integrates with tax authority systems for efficient reporting.

2. Automatic Filings: Submits required tax documentation on behalf of users.

*User Responsibilities*

1. Tax Obligations: Users remain responsible for reporting and paying taxes on earnings.

2. Accuracy: Ensure accuracy of tax information and reporting.

*MetaEarn's Tax Policy*

1. Transparency: Clearly outlines tax policies and procedures.

2. Compliance: Adheres to relevant tax laws and regulations.

3. Cooperation: Collaborates with tax authorities to ensure compliance.

*Regional Tax Considerations*

MetaEarn accommodates regional tax differences, including:

1. Value-Added Tax (VAT)

2. Goods and Services Tax (GST)

3. Regional income tax rates

*Future Developments*

MetaEarn continuously updates its tax handling to accommodate evolving tax regulations and user needs.

*Additional Resources*

For more information, users can access:

1. MetaEarn's Tax FAQ section

2. Tax Education Center

3. Customer Support

By prioritizing tax compliance and optimization, MetaEarn empowers users to manage their digital earnings with confidence.

Would you like more information on MetaEarn's tax handling or tax strategies?Here's more information on MetaEarn's tax handling:

*MetaEarn Tax Features*

1. Automated Tax Calculations

2. Real-time Tax Estimates

3. Detailed Tax Reports

4. Tax Form Generation (1099-MISC, K-1, etc.)

5. Integration with Tax Software (TurboTax, QuickBooks, etc.)

*Tax Implications for MetaEarn Activities*

1. Freelance Work: Self-employment taxes, business expense deductions

2. Online Trading: Capital gains taxes, wash sale rule implications

3. Cryptocurrency Investments: Capital gains taxes, IRS guidance compliance

*Regional Tax Considerations*

1. US Tax Law: Compliance with IRS regulations

2. EU Tax Law: VAT, GDPR considerations

3. Asia-Pacific Tax Law: Country-specific regulations (e.g., Australia, Japan)

*MetaEarn Tax Partnerships*

1. Tax Preparation Services (e.g., H&R Block)

2. Accounting Software Providers (e.g., Xero)

3. Tax Consultation Services (e.g., Ernst & Young)

*User Tax Obligations*

1. Reporting Earnings: Accurate tax reporting

2. Paying Taxes: Timely tax payments

3. Maintaining Records: Keeping accurate financial records

*MetaEarn Tax Education*

1. Tax Webinars

2. Tax Blog

3. Tax FAQ Section

4. Tax Calculator Tools

*Future Tax Developments*

1. AI-driven Tax Optimization

2. Blockchain-based Tax Reporting

3. Integration with Emerging Tax Technologies

Stay informed about MetaEarn's tax handling and updates through their official blog, social media, or customer support.

Would you like more information on a specific aspect of MetaEarn's tax handling?*MetaEarn: Unlocking Financial Freedom through Digital Earnings*

MetaEarn is a revolutionary platform empowering individuals to achieve financial independence through digital earnings. This innovative system combines cutting-edge technology with expert financial strategies, providing users with a comprehensive toolkit to manage and grow their wealth.

*Key Features:*

1. *Digital Income Streams*: MetaEarn offers diverse revenue sources, including freelance work, online trading, and cryptocurrency investments.

2. *Financial Education*: Expert-led webinars, tutorials, and resources to enhance financial literacy and smart investing.

3. *Automated Investment*: AI-driven portfolio management and dividend reinvestment for optimized returns.

4. *Community Support*: Networking opportunities with like-minded individuals and expert mentors.

5. *Reward System*: Incentives and bonuses for achieving financial milestones.

*Benefits:*

1. *Passive Income*: Generate consistent revenue without direct involvement.

2. *Financial Security*: Diversify investments and reduce risk.

3. *Personal Growth*: Develop valuable skills and financial acumen.

4. *Flexibility*: Accessible online, anytime, anywhere.

*Getting Started:*

1. Sign up on the MetaEarn platform.

2. Complete financial profile and risk assessment.

3. Explore income streams and investment options.

4. Engage with community and expert resources.

*Conclusion:*

MetaEarn revolutionizes the way people achieve financial freedom. By leveraging digital earnings, expert knowledge, and community support, individuals can break free from financial constraints and build a prosperous future.

*Join the MetaEarn movement today and unlock your financial potential!*

Would you like more information on MetaEarn or financial freedom strategies?MetaEarn, as a digital earnings platform, prioritizes transparency and compliance regarding tax implications. Here's an overview of how MetaEarn handles taxes:

*Tax Compliance*

1. User Reporting: MetaEarn provides detailed, downloadable reports on earnings, dividends, and transactions for tax purposes.

2. Tax Forms: Issues necessary tax forms (e.g., 1099-MISC, K-1) to users and relevant authorities.

3. Tax Withholding: Automatically withholds applicable taxes on earnings, ensuring compliance.

*Tax Optimization*

1. Expert Guidance: Offers access to certified tax professionals for personalized advice.

2. Tax-Efficient Strategies: Provides educational resources on minimizing tax liabilities.

3. Investment Optimization: AI-driven investment algorithms consider tax implications.

*Integration with Tax Authorities*

1. API Connections: Seamlessly integrates with tax authority systems for efficient reporting.

2. Automatic Filings: Submits required tax documentation on behalf of users.

*User Responsibilities*

1. Tax Obligations: Users remain responsible for reporting and paying taxes on earnings.

2. Accuracy: Ensure accuracy of tax information and reporting.

*MetaEarn's Tax Policy*

1. Transparency: Clearly outlines tax policies and procedures.

2. Compliance: Adheres to relevant tax laws and regulations.

3. Cooperation: Collaborates with tax authorities to ensure compliance.

*Regional Tax Considerations*

MetaEarn accommodates regional tax differences, including:

1. Value-Added Tax (VAT)

2. Goods and Services Tax (GST)

3. Regional income tax rates

*Future Developments*

MetaEarn continuously updates its tax handling to accommodate evolving tax regulations and user needs.

*Additional Resources*

For more information, users can access:

1. MetaEarn's Tax FAQ section

2. Tax Education Center

3. Customer Support

By prioritizing tax compliance and optimization, MetaEarn empowers users to manage their digital earnings with confidence.

Would you like more information on MetaEarn's tax handling or tax strategies?Here's more information on MetaEarn's tax handling:

*MetaEarn Tax Features*

1. Automated Tax Calculations

2. Real-time Tax Estimates

3. Detailed Tax Reports

4. Tax Form Generation (1099-MISC, K-1, etc.)

5. Integration with Tax Software (TurboTax, QuickBooks, etc.)

*Tax Implications for MetaEarn Activities*

1. Freelance Work: Self-employment taxes, business expense deductions

2. Online Trading: Capital gains taxes, wash sale rule implications

3. Cryptocurrency Investments: Capital gains taxes, IRS guidance compliance

*Regional Tax Considerations*

1. US Tax Law: Compliance with IRS regulations

2. EU Tax Law: VAT, GDPR considerations

3. Asia-Pacific Tax Law: Country-specific regulations (e.g., Australia, Japan)

*MetaEarn Tax Partnerships*

1. Tax Preparation Services (e.g., H&R Block)

2. Accounting Software Providers (e.g., Xero)

3. Tax Consultation Services (e.g., Ernst & Young)

*User Tax Obligations*

1. Reporting Earnings: Accurate tax reporting

2. Paying Taxes: Timely tax payments

3. Maintaining Records: Keeping accurate financial records

*MetaEarn Tax Education*

1. Tax Webinars

2. Tax Blog

3. Tax FAQ Section

4. Tax Calculator Tools

*Future Tax Developments*

1. AI-driven Tax Optimization

2. Blockchain-based Tax Reporting

3. Integration with Emerging Tax Technologies

Stay informed about MetaEarn's tax handling and updates through their official blog, social media, or customer support.

Would you like more information on a specific aspect of MetaEarn's tax handling?MetaEarn, as a digital earnings platform, prioritizes transparency and compliance regarding tax implications. Here's an overview of how MetaEarn handles taxes:

*Tax Compliance*

1. User Reporting: MetaEarn provides detailed, downloadable reports on earnings, dividends, and transactions for tax purposes.

2. Tax Forms: Issues necessary tax forms (e.g., 1099-MISC, K-1) to users and relevant authorities.

3. Tax Withholding: Automatically withholds applicable taxes on earnings, ensuring compliance.

*Tax Optimization*

1. Expert Guidance: Offers access to certified tax professionals for personalized advice.

2. Tax-Efficient Strategies: Provides educational resources on minimizing tax liabilities.

3. Investment Optimization: AI-driven investment algorithms consider tax implications.

*Integration with Tax Authorities*

1. API Connections: Seamlessly integrates with tax authority systems for efficient reporting.

2. Automatic Filings: Submits required tax documentation on behalf of users.

*User Responsibilities*

1. Tax Obligations: Users remain responsible for reporting and paying taxes on earnings.

2. Accuracy: Ensure accuracy of tax information and reporting.

*MetaEarn's Tax Policy*

1. Transparency: Clearly outlines tax policies and procedures.

2. Compliance: Adheres to relevant tax laws and regulations.

3. Cooperation: Collaborates with tax authorities to ensure compliance.

*Regional Tax Considerations*

MetaEarn accommodates regional tax differences, including:

1. Value-Added Tax (VAT)

2. Goods and Services Tax (GST)

3. Regional income tax rates

*Future Developments*

MetaEarn continuously updates its tax handling to accommodate evolving tax regulations and user needs.

*Additional Resources*

For more information, users can access:

1. MetaEarn's Tax FAQ section

2. Tax Education Center

3. Customer Support

By prioritizing tax compliance and optimization, MetaEarn empowers users to manage their digital earnings with confidence.

Would you like more inforHere's more information on MetaEarn's tax handling:

*MetaEarn Tax Features*

1. Automated Tax Calculations

2. Real-time Tax Estimates

3. Detailed Tax Reports

4. Tax Form Generation (1099-MISC, K-1, etc.)

5. Integration with Tax Software (TurboTax, QuickBooks, etc.)

*Tax Implications for MetaEarn Activities*

1. Freelance Work: Self-employment taxes, business expense deductions

2. Online Trading: Capital gains taxes, wash sale rule implications

3. Cryptocurrency Investments: Capital gains taxes, IRS guidance compliance

*Regional Tax Considerations*

1. US Tax Law: Compliance with IRS regulations

2. EU Tax Law: VAT, GDPR considerations

3. Asia-Pacific Tax Law: Country-specific regulations (e.g., Australia, Japan)

*MetaEarn Tax Partnerships*

1. Tax Preparation Services (e.g., H&R Block)

2. Accounting Software Providers (e.g., Xero)

3. Tax Consultation Services (e.g., Ernst & Young)

*User Tax Obligations*

1. Reporting Earnings: Accurate tax reporting

2. Paying Taxes: Timely tax payments

3. Maintaining Records: Keeping accurate financial records

*MetaEarn Tax Education*

1. Tax Webinars

2. Tax Blog

3. Tax FAQ Section

4. Tax Calculator Tools

*Future Tax Developments*

1. AI-driven Tax Optimization

2. Blockchain-based Tax Reporting

3. Integration with Emerging Tax Technologies

Stay informed about MetaEarn's tax handling and updates through their official blog, social media, or customer support.

Would you like more information*MetaEarn: Unlocking Financial Freedom through Digital Earnings*

MetaEarn is a revolutionary platform empowering individuals to achieve financial independence through digital earnings. This innovative system combines cutting-edge technology with expert financial strategies, providing users with a comprehensive toolkit to manage and grow their wealth.

*Key Features:*

1. *Digital Income Streams*: MetaEarn offers diverse revenue sources, including freelance work, online trading, and cryptocurrency investments.

2. *Financial Education*: Expert-led webinars, tutorials, and resources to enhance financial literacy and smart investing.

3. *Automated Investment*: AI-driven portfolio management and dividend reinvestment for optimized returns.

4. *Community Support*: Networking opportunities with like-minded individuals and expert mentors.

5. *Reward System*: Incentives and bonuses for achieving financial milestones.

*Benefits:*

1. *Passive Income*: Generate consistent revenue without direct involvement.

2. *Financial Security*: Diversify investments and reduce risk.

3. *Personal Growth*: Develop valuable skills and financial acumen.

4. *Flexibility*: Accessible online, anytime, anywhere.

*Getting Started:*

1. Sign up on the MetaEarn platform.

2. Complete financial profile and risk assessment.

3. Explore income streams and investment options.

4. Engage with community and expert resources.

*Conclusion:*

MetaEarn revolutionizes the way people achieve financial freedom. By leveraging digital earnings, expert knowledge, and community support, individuals can break free from financial constraints and build a prosperous future.

*Join the MetaEarn movement today and unlock your financial potential!*

Would you like more information on MetaEarn MetaEarn, as a digital earnings platform, prioritizes transparency and compliance regarding tax implications. Here's an overview of how MetaEarn handles taxes:

*Tax Compliance*

1. User Reporting: MetaEarn provides detailed, downloadable reports on earnings, dividends, and transactions for tax purposes.

2. Tax Forms: Issues necessary tax forms (e.g., 1099-MISC, K-1) to users and relevant authorities.

3. Tax Withholding: Automatically withholds applicable taxes on earnings, ensuring compliance.

*Tax Optimization*

1. Expert Guidance: Offers access to certified tax professionals for personalized advice.

2. Tax-Efficient Strategies: Provides educational resources on minimizing tax liabilities.

3. Investment Optimization: AI-driven investment algorithms consider tax implications.

*Integration with Tax Authorities*

1. API Connections: Seamlessly integrates with tax authority systems for efficient reporting.

2. Automatic Filings: Submits required tax documentation on behalf of users.

*User Responsibilities*

1. Tax Obligations: Users remain responsible for reporting and paying taxes on earnings.

2. Accuracy: Ensure accuracy of tax information and reporting.

*MetaEarn's Tax Policy*

1. Transparency: Clearly outlines tax policies and procedures.

2. Compliance: Adheres to relevant tax laws and regulations.

3. Cooperation: Collaborates with tax authorities to ensure compliance.

*Regional Tax Considerations*

MetaEarn accommodates regional tax differences, including:

1. Value-Added Tax (VAT)

2. Goods and Services Tax (GST)

3. Regional income tax rates

*Future Developments*

MetaEarn continuously updates its tax handling to accommodate evolving tax regulations and user needs.

*Additional Resources*

For more information, users can access:

1. MetaEarn's Tax FAQ section

2. Tax Education Center

3. Customer Support

By prioritizing tax compliance and optimization, MetaEarn empowers users to manage their digital earnings with confidence.

Would you like more inforHere's more information on MetaEarn's tax handling:

*MetaEarn Tax Features*

1. Automated Tax Calculations

2. Real-time Tax Estimates

3. Detailed Tax Reports

4. Tax Form Generation (1099-MISC, K-1, etc.)

5. Integration with Tax Software (TurboTax, QuickBooks, etc.)

*Tax Implications for MetaEarn Activities*

1. Freelance Work: Self-employment taxes, business expense deductions

2. Online Trading: Capital gains taxes, wash sale rule implications

3. Cryptocurrency Investments: Capital gains taxes, IRS guidance compliance

*Regional Tax Considerations*

1. US Tax Law: Compliance with IRS regulations

2. EU Tax Law: VAT, GDPR considerations

3. Asia-Pacific Tax Law: Country-specific regulations (e.g., Australia, Japan)

*MetaEarn Tax Partnerships*

1. Tax Preparation Services (e.g., H&R Block)

2. Accounting Software Providers (e.g., Xero)

3. Tax Consultation Services (e.g., Ernst & Young)

*User Tax Obligations*

1. Reporting Earnings: Accurate tax reporting

2. Paying Taxes: Timely tax payments

3. Maintaining Records: Keeping accurate financial records

*MetaEarn Tax Education*

1. Tax Webinars

2. Tax Blog

3. Tax FAQ Section

4. Tax Calculator Tools

*Future Tax Developments*

1. AI-driven Tax Optimization

2. Blockchain-based Tax Reporting

3. Integration with Emerging Tax Technologies

Stay informed about MetaEarn's tax handling and updates through their official blog, social media, or customer support.

Would you like more informationMetaEarn, as a digital earnings platform, prioritizes transparency and compliance regarding tax implications. Here's an overview of how MetaEarn handles taxes:

*Tax Compliance*

1. User Reporting: MetaEarn provides detailed, downloadable reports on earnings, dividends, and transactions for tax purposes.

2. Tax Forms: Issues necessary tax forms (e.g., 1099-MISC, K-1) to users and relevant authorities.

3. Tax Withholding: Automatically withholds applicable taxes on earnings, ensuring compliance.

*Tax Optimization*

1. Expert Guidance: Offers access to certified tax professionals for personalized advice.

2. Tax-Efficient Strategies: Provides educational resources on minimizing tax liabilities.

3. Investment Optimization: AI-driven investment algorithms consider tax implications.

*Integration with Tax Authorities*

1. API Connections: Seamlessly integrates with tax authority systems for efficient reporting.

2. Automatic Filings: Submits required tax documentation on behalf of users.

*User Responsibilities*

1. Tax Obligations: Users remain responsible for reporting and paying taxes on earnings.

2. Accuracy: Ensure accuracy of tax information and reporting.

*MetaEarn's Tax Policy*

1. Transparency: Clearly outlines tax policies and procedures.

2. Compliance: Adheres to relevant tax laws and regulations.

3. Cooperation: Collaborates with tax authorities to ensure compliance.

*Regional Tax Considerations*

MetaEarn accommodates regional tax differences, including:

1. Value-Added Tax (VAT)

2. Goods and Services Tax (GST)

3. Regional income tax rates

*Future Developments*

MetaEarn continuously updates its tax handling to accommodate evolving tax regulations and user needs.

*Additional Resources*

For more information, users can access:

1. MetaEarn's Tax FAQ section

2. Tax Education Center

3. Customer Support

By prioritizing tax compliance and optimization, MetaEarn empowers users to manage their digital earnings with confidence.

Would you like more infor*MetaEarn: Unlocking Financial Freedom through Digital Earnings*

MetaEarn is a revolutionary platform empowering individuals to achieve financial independence through digital earnings. This innovative system combines cutting-edge technology with expert financial strategies, providing users with a comprehensive toolkit to manage and grow their wealth.

*Key Features:*

1. *Digital Income Streams*: MetaEarn offers diverse revenue sources, including freelance work, online trading, and cryptocurrency investments.

2. *Financial Education*: Expert-led webinars, tutorials, and resources to enhance financial literacy and smart investing.

3. *Automated Investment*: AI-driven portfolio management and dividend reinvestment for optimized returns.

4. *Community Support*: Networking opportunities with like-minded individuals and expert mentors.

5. *Reward System*: Incentives and bonuses for achieving financial milestones.

*Benefits:*

1. *Passive Income*: Generate consistent revenue without direct involvement.

2. *Financial Security*: Diversify investments and reduce risk.

3. *Personal Growth*: Develop valuable skills and financial acumen.

4. *Flexibility*: Accessible online, anytime, anywhere.

*Getting Started:*

1. Sign up on the MetaEarn platform.

2. Complete financial profile and risk assessment.

3. Explore income streams and investment options.

4. Engage with community and expert resources.

*Conclusion:*

MetaEarn revolutionizes the way people achieve financial freedom. By leveraging digital earnings, expert knowledge, and community support, individuals can break free from financial constraints and build a prosperous future.

*Join the MetaEarn movement today and unlock your financial potential!*

Would you like more information on MetaEarn Here's more information on MetaEarn's tax handling:

*MetaEarn Tax Features*

1. Automated Tax Calculations

2. Real-time Tax Estimates

3. Detailed Tax Reports

4. Tax Form Generation (1099-MISC, K-1, etc.)

5. Integration with Tax Software (TurboTax, QuickBooks, etc.)

*Tax Implications for MetaEarn Activities*

1. Freelance Work: Self-employment taxes, business expense deductions

2. Online Trading: Capital gains taxes, wash sale rule implications

3. Cryptocurrency Investments: Capital gains taxes, IRS guidance compliance

*Regional Tax Considerations*

1. US Tax Law: Compliance with IRS regulations

2. EU Tax Law: VAT, GDPR considerations

3. Asia-Pacific Tax Law: Country-specific regulations (e.g., Australia, Japan)

*MetaEarn Tax Partnerships*

1. Tax Preparation Services (e.g., H&R Block)

2. Accounting Software Providers (e.g., Xero)

3. Tax Consultation Services (e.g., Ernst & Young)

*User Tax Obligations*

1. Reporting Earnings: Accurate tax reporting

2. Paying Taxes: Timely tax payments

3. Maintaining Records: Keeping accurate financial records

*MetaEarn Tax Education*

1. Tax Webinars

2. Tax Blog

3. Tax FAQ Section

4. Tax Calculator Tools

*Future Tax Developments*

1. AI-driven Tax Optimization

2. Blockchain-based Tax Reporting

3. Integration with Emerging Tax Technologies

Stay informed about MetaEarn's tax handling and updates through their official blog, social media, or customer support.

Would you like more informationMetaEarn, as a digital earnings platform, prioritizes transparency and compliance regarding tax implications. Here's an overview of how MetaEarn handles taxes:

*Tax Compliance*

1. User Reporting: MetaEarn provides detailed, downloadable reports on earnings, dividends, and transactions for tax purposes.

2. Tax Forms: Issues necessary tax forms (e.g., 1099-MISC, K-1) to users and relevant authorities.

3. Tax Withholding: Automatically withholds applicable taxes on earnings, ensuring compliance.

*Tax Optimization*

1. Expert Guidance: Offers access to certified tax professionals for personalized advice.

2. Tax-Efficient Strategies: Provides educational resources on minimizing tax liabilities.

3. Investment Optimization: AI-driven investment algorithms consider tax implications.

*Integration with Tax Authorities*

1. API Connections: Seamlessly integrates with tax authority systems for efficient reporting.

2. Automatic Filings: Submits required tax documentation on behalf of users.

*User Responsibilities*

1. Tax Obligations: Users remain responsible for reporting and paying taxes on earnings.

2. Accuracy: Ensure accuracy of tax information and reporting.

*MetaEarn's Tax Policy*

1. Transparency: Clearly outlines tax policies and procedures.

2. Compliance: Adheres to relevant tax laws and regulations.

3. Cooperation: Collaborates with tax authorities to ensure compliance.

*Regional Tax Considerations*

MetaEarn accommodates regional tax differences, including:

1. Value-Added Tax (VAT)

2. Goods and Services Tax (GST)

3. Regional income tax rates

*Future Developments*

MetaEarn continuously updates its tax handling to accommodate evolving tax regulations and user needs.

*Additional Resources*

For more information, users can access:

1. MetaEarn's Tax FAQ section

2. Tax Education Center

3. Customer Support

By prioritizing tax compliance and optimization, MetaEarn empowers users to manage their digital earnings with confidence.

Would you like more information on MetaEarn's tax handling or tax strategies? on a specific aspect of MetaEarn's tax handling?or financial freedom strategies?mation on MetaEarn's tax handling or tax strategies? on a specific aspect of MetaEarn's tax handling?mation on MetaEarn's tax handling or tax strategies?or financial freedom strategies? on a specific aspect of MetaEarn's tax handling?mation on MetaEarn's tax handling or tax strategies?

No comments yet

Be the first to share your thoughts!