**Airtm: Revolutionizing Global Financial Access with Digital Dollar Solutions**

### Introduction to Airtm

In a world where financial access and currency stability vary widely across borders, Airtm has emerged as a powerful platform for accessing and managing digital assets, especially in regions facing economic instability. Founded in 2015 by Ruben Galindo Steckel and Antonio GarcÃa, Airtm is a digital wallet and exchange service that facilitates cross-border transactions, peer-to-peer exchanges, and a unique digital dollar account. For many, Airtm provides a financial lifeline, offering stability, transparency, and the flexibility to engage in global financial systems.

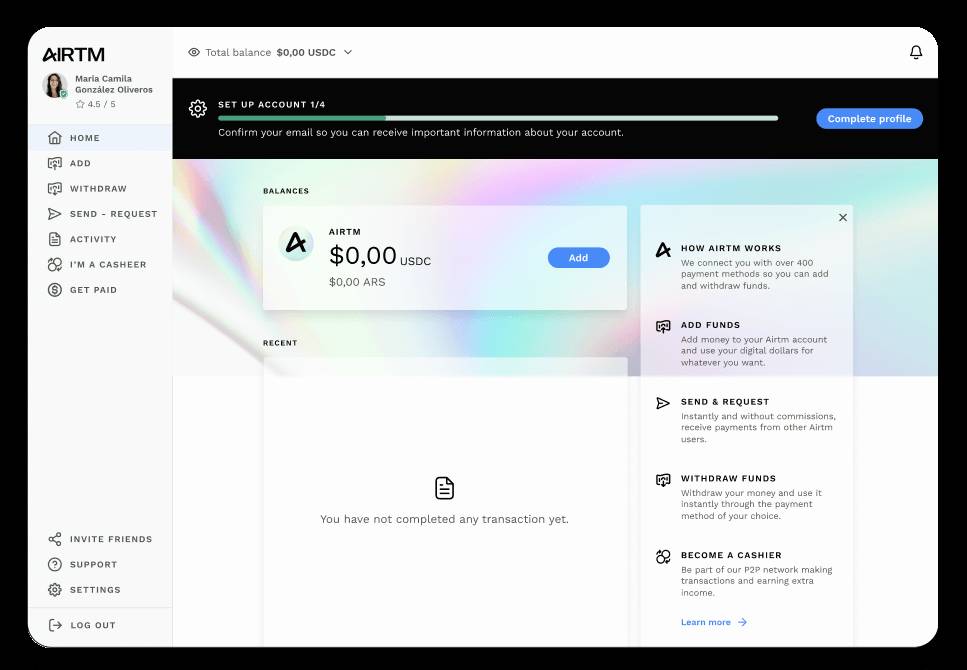

### How Airtm Works

At its core, Airtm is a digital wallet that allows users to store, send, and receive funds in digital dollars (AirUSD), pegged to the U.S. dollar, which maintains a stable value. Users can convert local currencies into AirUSD or exchange between currencies using Airtm’s peer-to-peer network or direct transfers. The platform also allows users to withdraw to or from bank accounts, mobile wallets, or other payment platforms in their respective countries.

Airtm's peer-to-peer network enables users to convert local currencies to AirUSD through intermediaries called "cashiers," who facilitate transactions and ensure liquidity. This model lets users access digital dollars without needing a direct connection to a bank that deals in U.S. dollars.

### Key Features of Airtm

1. **Access to Stable Digital Dollars (AirUSD)**: Airtm’s digital dollar solution, AirUSD, helps users protect their savings from inflation and currency volatility. By pegging AirUSD to the U.S. dollar, Airtm provides a stable financial asset that can be held, transferred, or converted back to local currencies.

2. **Peer-to-Peer (P2P) Network**: Airtm’s P2P network is a unique solution for users in countries with limited financial infrastructure. The P2P model connects users with cashiers who facilitate currency exchanges, adding flexibility to how users deposit or withdraw funds.

3. **Cross-Border Transfers**: Airtm enables seamless cross-border transactions, making it easy for freelancers, digital nomads, and remote workers to get paid by international clients. Businesses can also benefit from Airtm’s services to settle payments with vendors across the world.

4. **Multicurrency Support**: Airtm supports multiple local currencies, allowing users from diverse regions to convert between currencies, including the U.S. dollar, Mexican peso, Brazilian real, and many others.

5. **Secure & Transparent**: The platform uses secure encryption, and by leveraging blockchain and digital currency technology, it ensures transparency in transactions. Airtm is known for adhering to regulatory standards, which further boosts user trust.

### Target Market & Impact

Airtm’s primary users come from countries experiencing inflation, hyperinflation, or other forms of economic instability, where local currencies frequently lose value. Venezuela, Argentina, and Mexico are prominent markets, where users benefit significantly from accessing stable digital currency. Airtm also serves small businesses, freelancers, and digital workers who require cross-border payment solutions and prefer the flexibility and security that the platform offers.

**For freelancers**, Airtm offers a bridge between earning in foreign currency and spending in local currency, a boon in economies where accessing global payments is challenging.

**For unbanked populations**, Airtm’s P2P network enables them to access digital financial services, broadening financial inclusion.

### Airtm and Crypto Integration

Airtm has also integrated with several cryptocurrencies, allowing users to hold and transfer popular cryptocurrencies like Bitcoin and Ethereum. This has made the platform more versatile, appealing to crypto enthusiasts and investors who see value in both fiat and digital assets. Airtm’s crypto support also positions it as a bridge between traditional financial systems and the evolving world of digital finance.

### Challenges and Future Outlook

Despite its benefits, Airtm faces several challenges, including regulatory scrutiny, the evolving landscape of digital finance, and competition from other fintech companies. However, its ability to serve as a financial lifeline in volatile economies provides it with a unique niche that many competitors lack. Airtm’s future growth will likely involve expanding partnerships, enhancing the P2P network, and improving transaction efficiency to support larger volumes of users.

### Conclusion

Airtm stands as a groundbreaking platform in the fintech space, providing global access to financial stability in regions facing economic hardship. By offering access to digital dollars, P2P currency exchanges, and integration with cryptocurrency, Airtm is not just addressing a market need—it is creating a global financial ecosystem accessible to those who need it most. For individuals, freelancers, and businesses alike, Airtm offers a model of financial resilience and adaptability, essential for navigating the modern global economy.

No comments yet

Be the first to share your thoughts!