Global Inflation Surge: Unpacking Economic Forecasts and Future Concerns"

The world economy is facing mounting inflationary pressures, a situation that is redefining consumer and business behaviors, altering governmental policies, and impacting global growth forecasts. This inflation surge, driven by a unique blend of factors, remains at the forefront of global economic discussions, as experts warn of its far-reaching implications. For policymakers, central banks, and individuals alike, understanding the roots of this inflation is essential to navigating the uncertain economic landscape ahead.

Central to the inflationary rise is the COVID-19 pandemic, which severely disrupted supply chains across nearly every industry. When factories and suppliers shut down, production and transportation bottlenecks emerged, creating shortages in essential goods. As economies started to reopen, pent-up demand surged, but limited supplies couldn’t keep pace, leading to price hikes. A global energy crisis has also fueled inflation, with fossil fuel shortages and increased demand for renewables pushing energy costs to record levels. Geopolitical tensions, especially surrounding events like the Russia-Ukraine conflict, have further compounded this issue by disrupting global markets and food supplies.

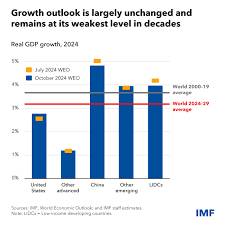

Forecasts by major economic bodies, such as the International Monetary Fund (IMF) and the World Bank, predict that inflationary pressures will persist, albeit with some moderation in the coming years. These organizations anticipate that the growth of the global economy may be tempered as central banks move to control inflation through interest rate hikes. Higher interest rates aim to reduce spending, which could slow demand and, ultimately, inflation. However, these measures carry the risk of reduced economic activity, and possibly, recession. Emerging markets, in particular, face increased challenges as they navigate the dual pressures of inflation and economic slowdown, all while managing currency fluctuations and debt burdens.

While inflation will impact every individual differently, those with lower incomes may suffer disproportionately, as essentials like food and energy consume a larger share of their budgets. Additionally, businesses are grappling with rising operational costs, which may result in downsizing or delayed expansions, further straining the labor market. Governments are, therefore, under pressure to offer targeted subsidies and welfare support to protect the most vulnerable.

In conclusion, global inflation and the economic forecasts tied to it signal a period of adjustment and potential hardship. Balancing inflation control with sustainable growth will require careful strategies from policymakers, and for individuals and businesses, adaptability will be key. As the world moves through this economic storm, the choices made now will determine the stability and resilience of the global economy in the years to come.

No comments yet

Be the first to share your thoughts!