Toast Inc. (NYSE: TOST), a cloud-based software provider for the restaurant industry, has hit a fresh 52-week high, with shares climbing to $40.56. This impressive milestone highlights the company’s exceptional growth over the past year, as its stock value has skyrocketed by a staggering 178.24%. The surge reflects growing investor confidence in Toast’s ability to thrive in the digital transformation sweeping the foodservice sector. By offering cutting-edge solutions that help restaurants optimize their operations and improve customer experiences, Toast has become a key player in the industry's tech evolution.

As Toast continues to expand its footprint, investors are eagerly watching its trajectory in the competitive tech space. The company’s ability to innovate and adapt is expected to be a major factor in sustaining its growth momentum.

Q3 Performance and Future Outlook: Stronger Than Ever

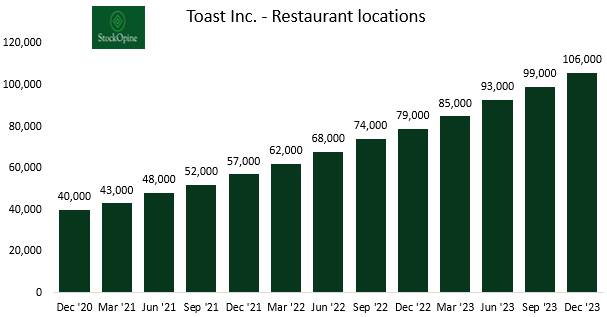

In its latest earnings report, Toast posted a robust performance for Q3, leading the company to raise its full-year forecast. The cloud-based platform added a remarkable 7,000 new restaurant locations, marking a 28% year-over-year growth. As of now, Toast’s platform powers nearly 127,000 locations worldwide. This growth has been fueled by Toast’s recurring revenue model, with gross profit increasing by 35%. The company also reported an adjusted EBITDA of $113 million and GAAP operating income of $34 million.

Toast's stellar Q3 results have prompted analysts to adjust their price targets, reflecting confidence in the company's strong prospects. While DA Davidson reduced its target from $55 to $44, it kept a "Buy" rating, citing the company's impressive EBITDA growth. In contrast, Mizuho Securities raised its price target from $33 to $40, maintaining an "Outperform" rating. This adjustment is based on Toast’s ability to lift its annual recurring gross profit forecast to a range of 32-33%, up from an earlier estimate of 27-29%.

Expanding Beyond Core Offerings

In addition to its impressive financials, Toast has been rolling out new products aimed at enhancing customer engagement. The company is also broadening its horizons by venturing into food and beverage retail, as well as expanding internationally. Notable partnerships include one with Potbelly Sandwich Works, further strengthening Toast’s market presence.

However, despite its growth, Toast has seen a rise in operational costs, which increased by 11% due to strategic investments in marketing, sales, and R&D. Despite these higher expenses, Toast is projecting a full-year adjusted EBITDA between $352 million and $362 million, with a margin of 26%.

Investor Insights and Market Trends

Toast’s recent stock surge is backed by strong market data. According to InvestingPro, the company has posted an incredible 171.38% price total return over the past year, coupled with impressive short-term momentum—up 22.19% in the last week and 41.81% over the past month. This performance has helped Toast trade near its 52-week high, reinforcing the company's strong growth narrative.

However, analysts also point out that Toast’s gross profit margins remain a concern, as they stand at just 23.36% for the last twelve months. Still, many remain optimistic about the company’s future, with forecasts suggesting Toast will become profitable in the near term.

Looking Ahead

As Toast continues to grow and innovate, its ability to navigate the competitive landscape will be crucial in determining whether it can sustain its impressive performance. The market remains intrigued by the company’s ability to tap into new opportunities, from expanding its customer base to diversifying its product offerings. As the restaurant industry embraces more technology, Toast's innovative solutions position it well for continued success.