"Stop Living Paycheck to Paycheck: Master Budgeting with These Simple Steps"

Struggling to make your money last until the end of the month? You're not alone. The good news is that with a solid budgeting plan, you can break free from the paycheck-to-paycheck cycle and take control of your finances. Here's how to get started:

1. Track Every Dollar

1. Track Every Dollar

The first step to mastering your budget is understanding where your money goes.

- Use Budgeting Tools: Apps like Mint, YNAB (You Need A Budget), or even an Excel sheet can help.

- Categorize Expenses: Split spending into fixed costs (rent, utilities) and variable expenses (groceries, entertainment).

- Look for Trends: Identify areas where you're overspending—those daily coffee runs might add up to a vacation!

2. Set Clear Financial Goals

Budgeting works best when you’re working toward something specific.

- Short-Term Goals: Save for a holiday, pay off credit card debt, or build a $1,000 emergency fund.

- Long-Term Goals: Save for a house, start an investment fund, or plan for retirement.

- Use Visuals: A progress chart or app tracker can keep you motivated.

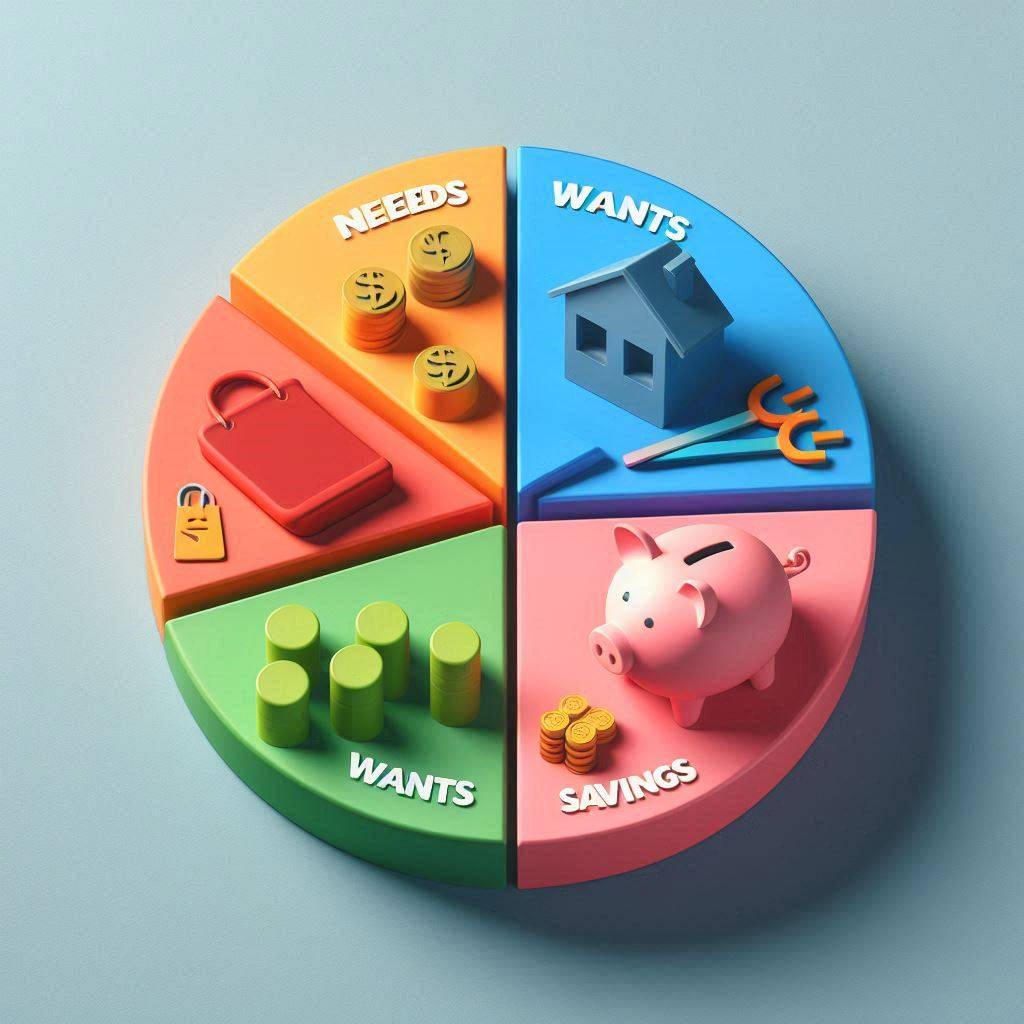

3. The 50/30/20 Rule: A Simple Budgeting Framework

This classic rule is easy to follow and flexible enough for any income level:

- 50% Needs: Rent, groceries, transportation.

- 30% Wants: Hobbies, dining out, subscriptions.

- 20% Savings/Debt Repayment: Emergency funds, retirement savings, or paying off loans.

4. Automate Your Finances

Take the guesswork out of budgeting by automating:

- Direct Deposit Savings: Set up automatic transfers to your savings account.

- Auto-Bill Payments: Avoid late fees by automating recurring bills.

- Round-Up Apps: Tools like Acorns round up transactions and invest the spare change.

5. Adjust and Refine Regularly

5. Adjust and Refine Regularly

Life changes, and so should your budget.

- Monthly Check-Ins: Review your budget to see what worked and what didn’t.

- Plan for the Unexpected: Allocate a small amount each month for unpredictable expenses.

- Celebrate Wins: Reward yourself for sticking to your budget—just don’t blow the budget celebrating!

Why Budgeting Matters

Budgeting isn’t about restrictions; it’s about empowerment. By controlling your spending, you can save for the things that truly matter and reduce financial stress. Whether it’s achieving financial freedom, retiring early, or simply having enough for a rainy day, budgeting is the key to unlocking your goals.

Start small, stay consistent, and watch your financial health transform!

Humor bonus: Remember, a budget isn’t a prison sentence—it’s a game plan. And who doesn’t want to win the game of “I still have money left at the end of the month� 💸🎉

No comments yet

Be the first to share your thoughts!