Exploring Wise: The Revolutionary Money Transfer App

In today’s interconnected world, managing finances across borders is more important than ever. The Wise app (formerly known as TransferWise) has emerged as a game-changer in the realm of international money transfers, offering a transparent, fast, and affordable solution for millions of users worldwide.

What is the Wise App?

Wise is a financial technology platform designed to simplify international money transfers. Established in 2011 by Kristo Käärmann and Taavet Hinrikus, Wise was born out of frustration with the high fees and hidden costs associated with traditional bank transfers. The app provides a user-friendly, cost-effective way to send, spend, and manage money across currencies.

Key Features of the Wise App

1. Low Fees and Transparent Pricing

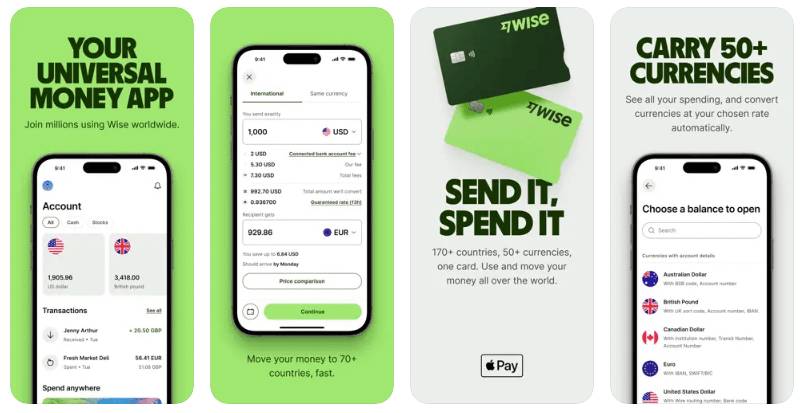

Wise is renowned for its low fees and transparent pricing. Unlike traditional banks, Wise uses mid-market exchange rates, which means no hidden markups. Users can see exactly how much they’ll pay and how much the recipient will receive before confirming a transaction.

2. Multi-Currency Accounts

The Wise app offers multi-currency accounts, allowing users to hold and manage money in over 50 currencies. This feature is particularly beneficial for frequent travelers, expats, and businesses operating globally.

3. Fast Transfers

Wise leverages local banking systems to speed up transfers. In many cases, money arrives within hours, making it one of the fastest options for international transactions.

4. Borderless Debit Card

Wise users can apply for a debit card that works in multiple currencies. The card allows users to spend abroad at the real exchange rate, saving on conversion fees.

5. Business Solutions

For businesses, Wise offers features like batch payments, API integrations, and invoice management, making it a preferred choice for small and medium enterprises (SMEs).

How Does Wise Work?

The process of using the Wise app is straightforward:

1. Sign Up: Create an account via the app or website.

2. Enter Details: Specify the amount, recipient’s information, and currency.

3. Make Payment: Fund the transfer using your debit card, credit card, or bank account.

4. Track Progress: Use the app to track your transfer in real time.

Why Choose Wise?

1. Cost-Effective: Wise eliminates the high fees and poor exchange rates typical of traditional banks.

2. User-Friendly Interface: The app is intuitive, making it accessible even for non-tech-savvy users.

3. Trustworthy and Secure: Regulated by financial authorities worldwide, Wise ensures the security of your money.

4. Global Reach: With support for over 80 countries, Wise caters to a diverse user base.

Challenges and Limitations

While Wise has many advantages, it is not without limitations. For instance, it does not offer credit facilities or traditional banking services. Additionally, transfer speeds may vary depending on the payment method and recipient’s bank.

Conclusion

The Wise app has redefined how individuals and businesses manage international money transfers. Its transparency, affordability, and efficiency make it a standout option in a crowded market. Whether you’re sending money to family abroad, paying for international services, or managing a global business, Wise is a reliable financial ally.

By prioritizing user needs and challenging traditional banking norms, Wise has positioned itself as a leader in financial technology, making cross-border transactions simpler and more accessible for all.

No comments yet

Be the first to share your thoughts!