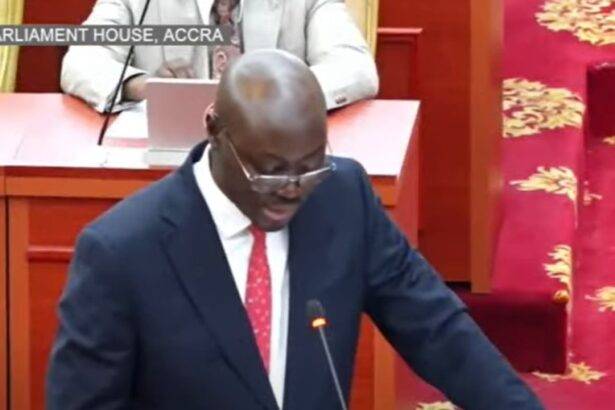

Finance Minister Dr. Cassiel Ato Forson has introduced eight legislative bills to Parliament, fulfilling the government's pledge to abolish the Electronic Transfer Levy (E-Levy) and betting tax, among others. The bills, presented on March 13, 2025, include the Electronic Transfer Levy (Repeal) Bill, Ghana Infrastructure Investment Fund (Amendment) Bill, Revenue Administration (Amendment) Bill, and Special Import Levy (Amendment) Bill. Others are the Emissions Levy (Repeal) Bill, Income Tax (Amendment) Bill, Growth and Sustainability Levy (Amendment) Bill, and Earmarked Funds Capping and Realignment (Amendment) Bill, all aimed at tax reform. Dr. Forson appealed to Parliament to expedite the process by considering the bills under a certificate of urgency, stressing that the proposed repeals are essential to reducing the financial burden on citizens and businesses.

Prior to presenting the bills, Dr. Forson had assured the public that the repeal process would be simple, requiring only a single clause for each tax. He emphasized that eliminating the betting tax and E-Levy, in particular, would be straightforward, as both levies had faced significant opposition since their introduction. The Finance Minister explained that these tax cuts are part of the government's broader plan to reshape the tax structure, stimulate economic growth, and create a more business-friendly environment. The decision to remove the levies follows concerns raised by the public and various stakeholders about their negative impact on digital transactions and the gaming industry. The repeal of these taxes is expected to improve financial inclusivity and ease the cost of doing business in the country.

Dr. Forson’s move signals a major policy shift aimed at tax relief for individuals and businesses while addressing concerns about revenue collection efficiency. The success of these proposed repeals now depends on Parliament’s response and the legislative process. If approved, the removal of these taxes will mark a significant change in Ghana’s fiscal landscape, potentially boosting economic activity and encouraging investment. However, questions remain about how the government will offset the revenue losses from these tax cuts. The debate in Parliament will likely shape the final decision, as lawmakers weigh the potential economic benefits against the need for sustainable public finances.

No comments yet

Be the first to share your thoughts!