Trump’s Economic Reset Plan: A Strategic Vision for the Future

In the world of global economics, few events can match the complexity and high stakes of a national economy on the brink of crisis. Currently, the United States faces a daunting $38 trillion debt, a ticking time bomb that could potentially lead to a sovereign default — a collapse that would reverberate across the globe. In the midst of this looming threat, former President Donald Trump is positioning himself to spearhead a strategic economic reset. His plan, while controversial, could very well serve as the blueprint to avoid the worst-case scenario and propel the U.S. into a new economic cycle.

At the core of Trump’s approach is the idea that the current economic system is unsustainable in its current form. With inflation at historically high levels, a massive national debt, and the Federal Reserve grappling with interest rates and liquidity, the economic landscape is fragile. However, Trump believes that through a series of carefully orchestrated moves, he can reset the economy in a way that will not only avoid the collapse but will also create a new growth cycle that benefits emerging technologies — particularly cryptocurrencies.

Step 1: Stop Inflation – The Role of Bitcoin and Liquidity Drain

The first part of Trump’s plan involves stopping inflation, which has become a growing concern in the U.S. and around the world. With inflation eating into the purchasing power of the dollar, the government's priority is to stabilize prices and restore confidence in the monetary system. One key aspect of Trump’s strategy is to promote Bitcoin and other digital assets as a hedge against the inflationary pressures of fiat currencies. In many ways, Bitcoin has already proven its value as a store of value, with many viewing it as "digital gold."

Trump’s plan likely revolves around supporting policies that reduce the liquidity in the financial system, effectively curbing the speculative and inflationary tendencies of the market. By tightening the monetary supply and simultaneously supporting Bitcoin's growth as an alternative, Trump aims to create an environment where the dollar can stabilize while encouraging the growth of decentralized currencies. This would prevent further dollar devaluation, an important step for the U.S. to retain its economic power on the global stage.

Step 2: Slow Economy – A Hard Stance on China Tariffs

The second phase of Trump’s reset plan involves deliberately slowing down the economy, a move that might seem counterintuitive at first. However, this step is aimed at rebalancing the economic forces in favor of the United States. Central to this strategy is imposing significant tariffs on Chinese goods, up to 36%, in an attempt to level the playing field for American industries and curb the outsourcing of jobs and manufacturing.

China has long been the beneficiary of a global trade system that heavily favored its economic model, often resulting in trade imbalances that hurt the U.S. manufacturing sector. By raising tariffs, Trump seeks to create economic pressure on China and force a renegotiation of trade deals that could reduce the overall reliance on Chinese imports. While the immediate effect of these tariffs would likely slow down the economy, the long-term goal is to rebuild American industrial capacity, reduce the national debt, and foster a more balanced global economic environment.

Step 3: Force Fed Rate Cuts to 0-2%

The third element of Trump’s plan is aimed at the Federal Reserve, the central body responsible for regulating interest rates and ensuring the stability of the U.S. financial system. In this reset, Trump seeks to force the Fed to cut interest rates, potentially down to between 0-2%. These cuts would provide much-needed liquidity into the economy, stimulate investment, and help businesses grow despite the artificial slowdown caused by the tariffs.

While low interest rates might seem like a recipe for inflation, Trump’s approach is more calculated. With inflation curbed and the dollar stabilized, lower interest rates could effectively unlock economic growth by making it cheaper to borrow money. This, in turn, could boost consumer spending, business expansion, and private sector investments, all of which are critical for long-term economic prosperity.

The Outcome: A Controlled Crisis Leading to New Growth

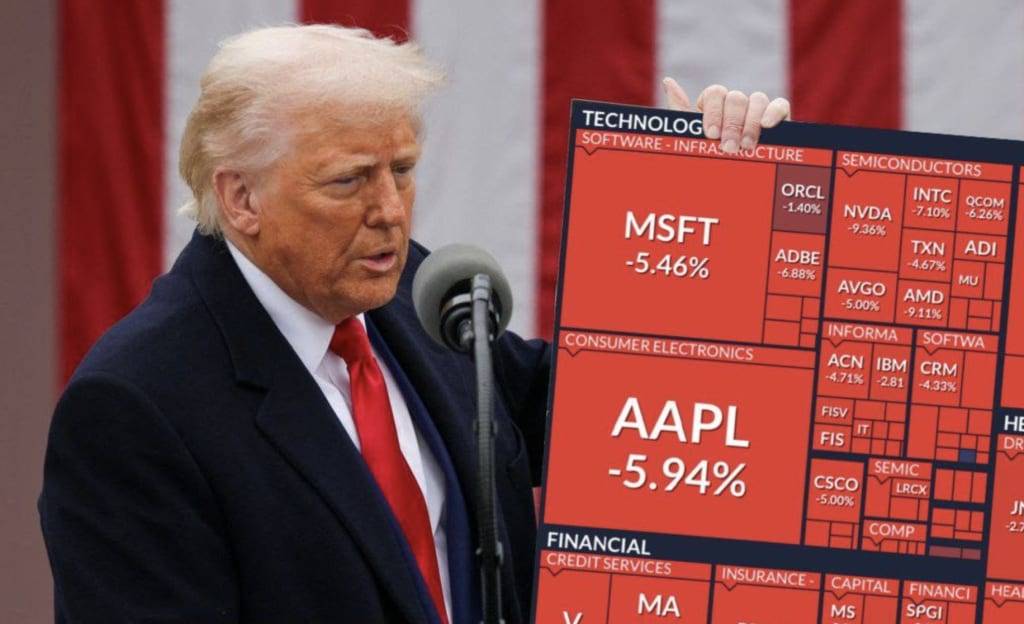

In the short term, this economic reset is likely to cause a period of turmoil — a "manufactured crisis" designed to shake out inefficiencies, over-leveraged companies, and unsustainable financial practices. During this time, there may be significant market volatility, with stocks, bonds, and even real estate facing downward pressure.

However, Trump’s plan is not about panic; it is about controlled chaos. The idea is to ensure that the U.S. does not default on its debt by effectively "resetting" the system. Once the short-term crisis phase is over, the Federal Reserve will pivot, and the money printer will be re-engaged — this time, with a focus on monetary policies that support new growth and innovation.

This phase would likely involve renewed quantitative easing (QE) — a monetary tool used by the Fed to inject liquidity into the system by purchasing government bonds. With this influx of capital, emerging sectors such as cryptocurrency, blockchain technology, and artificial intelligence would find fertile ground for explosive growth.

The Crypto Boom: Positioning for a New Era

One of the key beneficiaries of this reset would be cryptocurrency, which Trump has consistently seen as an important component of the future financial system. By 2026-2028, the stage will be set for what could become a "supercycle" for risk assets — including cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH). The massive liquidity from the Fed's actions would flood into these assets, driving their prices to unprecedented heights.

For savvy investors, the strategy is clear: accumulate BTC and ETH during the “crisis phase†when prices are still relatively low and the market is unstable. As the Fed pivots and the crypto boom begins, those who have positioned themselves correctly will stand to benefit enormously.

Conclusion: Navigating a Macro Chess Game

Trump’s economic reset plan is not without risk. The artificial slowdown, trade tensions, and potential market disruptions could create significant short-term pain for many. However, the ultimate goal is to engineer a controlled reset that avoids a catastrophic sovereign default and creates the optimal conditions for a new growth cycle — one in which risk assets, especially cryptocurrency, play a central role.

This economic strategy is a macro chess game in progress, and while it is not financial advice, it’s clear that the broader vision centers around emerging technologies and shifting the global economic order in favor of those prepared to adapt. The next few years will be pivotal in shaping the future of the U.S. economy and the world at large.

So, while it may be tempting to panic in the face of an unfolding crisis, rest assured that this strategy is designed with long-term stability in mind. The best move for those observing this chess game? Be prepared, and pay attention to the signals from the market — because the economic reset is coming, and with it, a new era of growth.