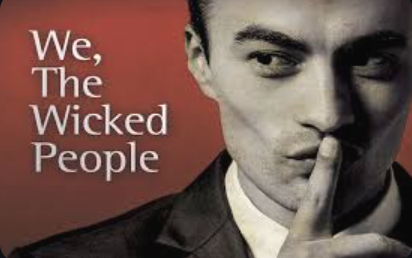

You expect to leave a bank with a clear repayment schedule, clarity, and confidence after applying for a loan. But what if I told you that most borrowers don't detect a hidden secret in loan agreements that might cost you thousands?

Today, I am revealing the little-known facts regarding refundable risk fees and why many banks are hiding money that should be returned.

What is a risk premium fee?

A risk charge is a payment added to your loan to compensate for service charges and the rest in case you default payment. Thus, that percentage is added depending the economic situations, the type of your loan and the level of trust the bank has in you the borrower.

This is how the risk premium means

Sounds reasonable, doesn't it? In theory, it is.

However, in fact, most borrowers do not get this amount back because they never got to know.

The fact that these risk fees are refundable is not often made clear to consumers by banks. Unless you ask, some people never even bring it up. Even fewer automatically return the money at the conclusion of the loan period.

Technically, you can get a refund if you paid back your loan on schedule, but only if you remember to do so (and occasionally fight for it).

WHAT IS THE WAY FORWARD???

Now we have got to know their secret, but how are you going to detect how they have coined this term?

Look for these terms on your loan contracts

- Risk Fee

- Security Deposit

- Refundable Security Deposit

- Loan Reserve

Banks operate on silence, try and consult them or else they will never reach out to you to pay this money back.