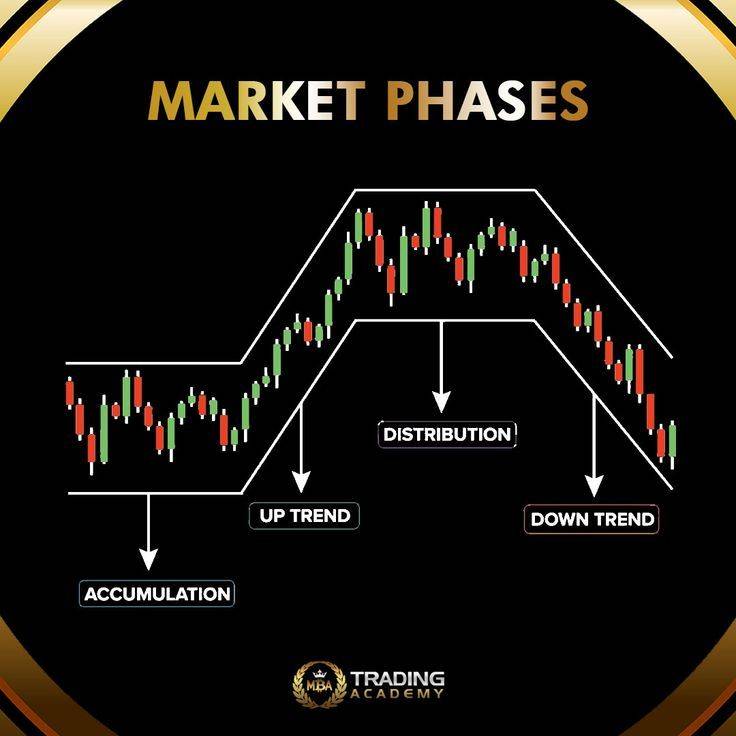

Financial markets are dynamic systems that go through various phases, each with distinct characteristics. Understanding these phases is crucial for investors, traders, and financial analysts to make informed decisions. The four phases of financial markets are accumulation, markup, distribution, and markdown.

The accumulation phase is the first stage of a market cycle, where smart money investors, such as institutional investors and experienced traders, start buying assets at low prices. During this phase, the market is often quiet, with minimal media attention, and prices may even continue to decline. However, savvy investors recognize the potential for growth and start accumulating positions. According to Howard Marks, co-founder of Oaktree Capital Management, "The most important characteristic of the accumulation phase is that it's the time when investors can get the best deals" (Marks, 2011).

The markup phase follows the accumulation phase, where the market starts to gain momentum, and prices begin to rise. This phase is characterized by increasing investor enthusiasm, improved economic fundamentals, and growing media attention. As prices rise, more investors jump into the market, fueling the upward trend. During this phase, investors who accumulated positions during the previous phase start to see significant returns. According to Robert Prechter, a well-known Elliott Wave analyst, "The markup phase is the most profitable time for investors, but it's also the time when the most mistakes are made" (Prechter, 2014).

The distribution phase marks the peak of the market cycle, where smart money investors start selling their positions to less experienced investors who are eager to jump into the market. During this phase, prices may continue to rise, but at a slower pace, and investor sentiment becomes increasingly bullish. However, savvy investors recognize the signs of a topping market and start distributing their assets to less informed investors. According to Charles Mackay, author of "Extraordinary Popular Delusions and the Madness of Crowds," "The distribution phase is characterized by a sense of complacency among investors, who believe the market will continue to rise indefinitely" (Mackay, 1841).

The markdown phase is the final stage of the market cycle, where prices decline sharply, and investor sentiment turns bearish. During this phase, investors who bought into the market during the distribution phase suffer significant losses as prices plummet. According to John Templeton, a legendary investor, "The markdown phase is the most challenging time for investors, as it requires discipline and patience to withstand the downward pressure" (Templeton, 1993).

Understanding the four phases of financial markets is essential for investors to make informed decisions and avoid costly mistakes. Recognizing the characteristics of each phase can help investors position themselves for success and minimize losses. Investors who can identify the accumulation phase can accumulate positions at low prices, while those who recognize the distribution phase can sell their positions before the market declines.

Discipline, patience, and a deep understanding of market cycles are essential for investors to navigate the complexities of financial markets. Investors who can recognize the signs of each phase and adjust their strategies accordingly are more likely to achieve their investment goals. Continuous learning and staying updated with market trends are crucial for investors to stay ahead of the curve and make informed decisions that drive long-term success.

No comments yet

Be the first to share your thoughts!