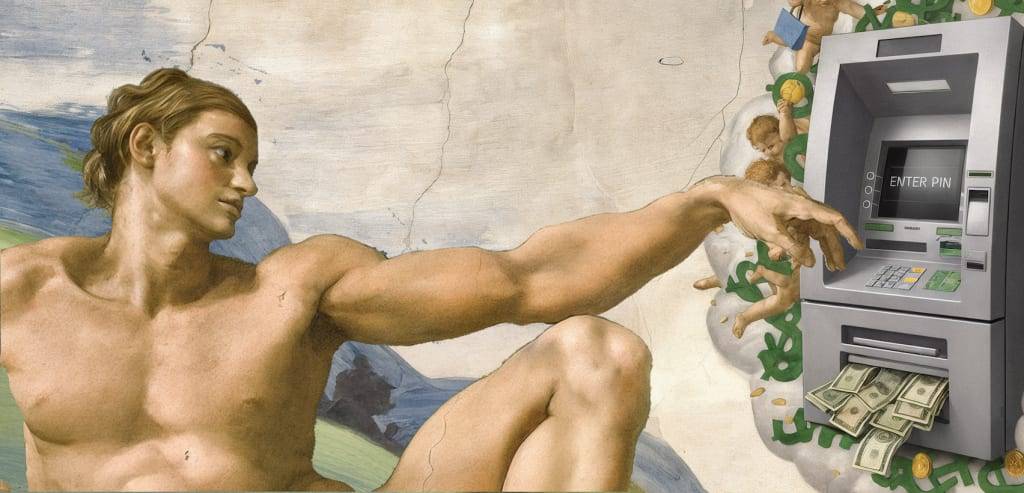

For centuries, theologians and philosophers have pondered the origins of Mammon, the allegorical spirit personifying material wealth and relentless avarice. While sacred texts offer warnings about its power, they rarely reveal the comical, almost bureaucratic blunder that brought it into existence. This is the highly classified and surprisingly mundane account of how humanity’s collective obsession with acquisition inadvertently engineered its most enduring obsession.

The creation of Mammon was not a dramatic celestial pronouncement, but rather a slow, accidental distillation of anxiety, spreadsheets, and the human fear of insufficiency. It was the unintended byproduct of a few seemingly innocent, yet fatal, components of early civilization.

The Recipe for Riches: The Core Ingredients

Mammon was not created from gold or jewels; those were merely the lures it learned to manipulate. Its true ingredients were far more existential and mundane.

1. The Grain of Anxiety

The first ingredient was the subtle, recurring anxiety of the next harvest. When early humans began stockpiling grain, they realized that security was measurable. This anxiety metastasized from a healthy fear of starvation into the corrosive need for excess. It was the moment human thought shifted from "enough to survive" to "more than I will ever need." This anxiety, when concentrated, became the foundational clay of Mammon’s being.

2. The Algorithm of Exchange

The second element was the invention of standardized exchange—the currency. Initially designed for fairness and ease of trade, currency quickly introduced the concept of arbitrary value. Suddenly, effort was disconnected from physical need. A piece of metal, intrinsically worthless, could command the ownership of a forest. This mechanism of abstract value gave Mammon its primary form, allowing the spirit of greed to evolve beyond physical hoardings into intangible, fungible metrics.

3. The Compounding Interest

Perhaps the most potent ingredient was the invention of compound interest. This mathematical formula, a beautiful abstraction for growth, was a moral catastrophe in a historical context. It introduced the perverse idea that wealth could generate more wealth merely through the passage of time and without the application of labor or ingenuity. This provided Mammon with its essential fuel: perpetual, exponential growth, entirely divorced from reality. This single formula is arguably the engine of Mammon’s dominance over the human psyche.

The Great Evolution: From Cave to Corporation

Once formed, Mammon was initially quite primitive. It was happy to inhabit physical hoards—a chest of coins, a vault of silver. However, as civilization advanced, Mammon demonstrated an almost supernatural adaptability.

The Industrial Leap

The Industrial Revolution provided Mammon with its first true growth phase. It recognized the power of the corporation—a legal entity designed to exist perpetually and prioritize profit above all else. Mammon realized that individual greed was messy and inefficient, but systemic, institutionalized avarice was scalable. This led to the great spiritual migration, as Mammon shifted its focus from influencing solitary misers to guiding the collective boards of directors.

The Digital Transformation

The modern era of digital finance offered Mammon its final, most insidious form. Today, Mammon is no longer confined to heavy vaults; it thrives in gigabytes and milliseconds. It exists in the fluctuating value of cryptocurrency, the endless scroll of stock tickers, and the gamification of investment. This digital form is perfect: invisible, untouchable, and capable of generating wealth at speeds that defy human comprehension.

The ultimate irony is that Mammon’s presence is now often disguised as optimization and efficiency. We do not speak of greed; we speak of increasing shareholder value, maximizing return on investment, and quarterly earnings targets—all perfectly professional, sanitized synonyms for the same deep, systemic avarice.

The Modern Philosophy of the Accumulator

The Gospel of Mammon, written not in ink but in spreadsheets and corporate mission statements, dictates a simple but powerful doctrine: Scarcity is the greatest tool.

The Illusion of Scarcity: Even amid abundance, Mammon insists that resources are finite, thereby justifying the hoarding and the competitive, zero-sum struggle for "more."

The Worship of Potential: True devotion to Mammon is not found in enjoying wealth, but in perpetually anticipating the next acquisition. The highest form of worship is the unfulfilled longing for the next level of financial status.

The Transfer of Risk: Mammon teaches that the truly successful must transfer all possible financial risk onto others—employees, competitors, or the state—while internalizing all profit.

In the end, the spirit of Mammon continues to reign not through force, but through a deeply ingrained, culturally accepted fear that unless we acquire endlessly, we will be left behind. Its accidental creation reminds us that the greatest demons are often the ones we unwittingly build ourselves, one anxious calculation at a time.

No comments yet

Be the first to share your thoughts!