THE E-LEVY AND ITS CONTROVERSY

ALL YOU NEED TO KNOW.

Somewhere next week Parliament will be back to the house to continue with debate on the E-Levy.

The question here is, has the motion been well debated by both sides of the house?

Parliamentarians and individuals have been talking about the introduction of the Electronic Levy that the Government in power is trying to introduce into the system.

This was made known by the Finance Minister, Ken ofori Atta on his presentation of 2022 budget to Parliament.

If I may ask, are Ghanaian interested in this E-Levy? Do the Service Providers pay tax? Is the 1% service charge and now the 1.75% tax on transactions not a recipe for disaster? Why is government highly interested in e-levy instead of other sources of revenue to fund government projects? What happened to the oil and gold revenues? Are we saying it is only the e-levy that is coming to solve the problems facing Ghana's economy? Hmmm.

It is an undeniable fact that this e-levy will force some people to resort to the use of physical cash. For the majority, there is no viable alternative. At the moment, electronic payment, especially mobile money, is the most efficient and cost effective means of transferring money since it is widely accessible in every corner of the country. It is widely used because of it's convenience especially in rural areas.

The only alternative is to revert to the "traditional" banks, which have limited branches. Come to think of it, these banks themselves are now digitizing their services to minimize the use of cash in a much talk about cashless society.

First and foremost, what is Mobile Money? Mobile money is an Electronic wallet.

The money in the mobile money wallet is for the individual. If I may ask, do you pay a tax when you sign a cheque?

Why should anyone be taxed carrying out transactions through Electronic wallet?

Mobile money should not be regarded as a taxable commodity.

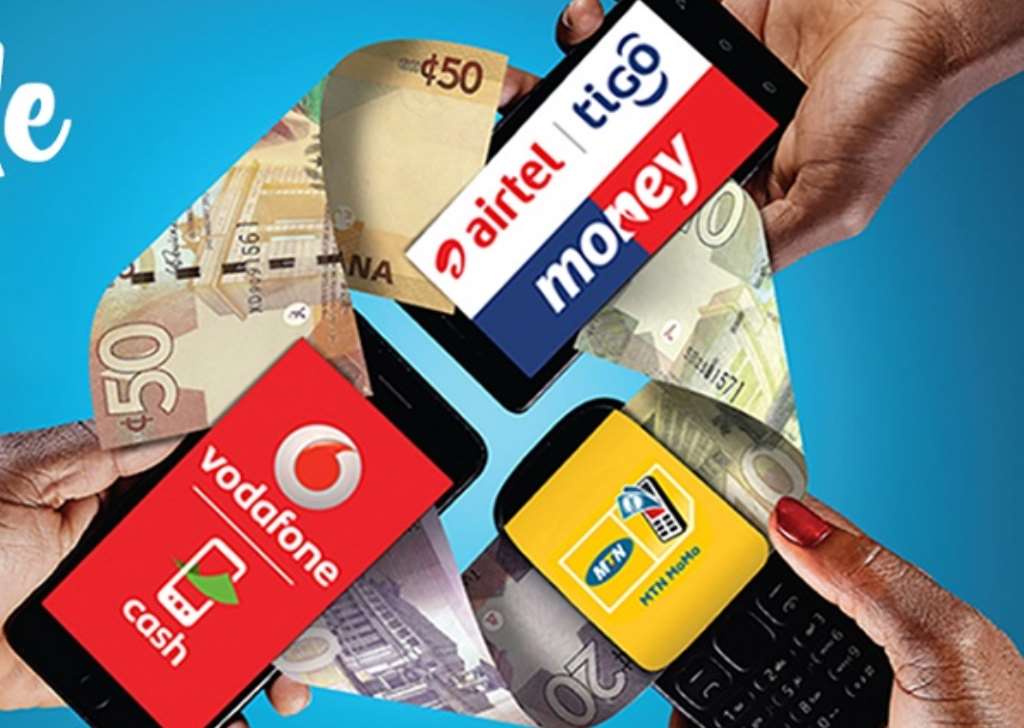

When you have money in your wallet, should it be safe there? We are already paying charges to our service providers, thus the MTN, and AIRTELTIGO with the exception of VODAFONE that makes it free when you send money.

You are paying money for servicing; just like running your bank account, where until a transaction is made, bank charges do not apply.

Mobile money is an electronic bank, so, why should Ghanaians be made to pay tax on an Electronic bank transaction, which is not applicable to the traditional banking transactions? This is not fair at all?

Ghanaians have only been told that, this e-levy will generate revenue to the state, without considering the negative impact on the individuals. Why won't the government check the losses that hit the country via corruption and unscrupulous spending on the part of government officials? What is good for the goose is good for the gander.

This Electronic Levy needs to be redrawn. it is of no importance to Ghanaians. This is not a tax, it is a direct money extortion from Ghanaians. This is why I am trying to make it clear that this E-Levy must be redrawn.

If you are "broke" do you just break into peoples houses to steal? It is not done that way. Let us say, you leave your house for work and forgot to put money on the table for evening meal. Should you be taxed for sending money home via mobile money? This is exactly what the government of the day seek to portray. Your child is in school and calls you that he or she needs money to pay school fees or money for up keep, you will have to pay tax for paying your ward's school fees?

This can't be possible. Ghanaians will really suffer if this E-Levy is passed through.

We anticipate to hear something good from our lawmakers as they return to the floor to debate on this topic once again. The Government and the majority group in Parliament needs to understand that this E-Levy is of no benefit to the citizenry; it will only put more burden on them.

#GOD HELP OUR MOTHER LAND.

WRITTEN BY:ALEX BRYANT

No comments yet

Be the first to share your thoughts!