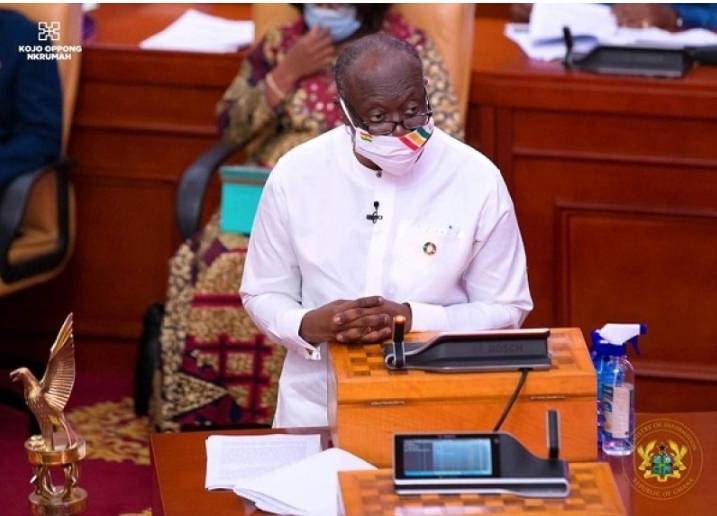

The Minister of Finance, Mr Ken Ofori-Atta is expected to announce the operational date for the Electronic Transfer Levy Bill (E-Levy) Bill which was assented to by President Nana Addo Dankwa Akufo-Addo Thursday.

Parliament approved the bill last Tuesday after the Minority had staged a walkout as part of their avowed protest against the bill.

The bill initially imposed a 1.75 per cent tax on all electronic transactions and money transfers, but the rate was reduced to 1.5 per cent before its passage.

As part of the bill, any transfer to or from a mobile money account or from a bank account of a person will be subject to the tax.

These include:

1. Transfers done on the same. mobile money network For example sending money from your MTN Momo wallet to another. person's MTN Momo wallet.

2. Transfers from one mobile money network to a recipient on another network For example, sending money from your MTN Momo wallet to another person's TIGO Cash wallet.

3. Transfers from bank accounts to mobile money accounts: For example, Kofi transfers money from his CBG bank account to Ama's MTN mobile money wallet.

4. Transfers from mobile money accounts to bank accounts: For example, Esi transfers money from her Vodafone Cash money wallet to Yaw's GCB bank account.

5. Bank transfers on a digital platform or application which originate from a bank account belonging to an individual: For example, Kwame transferring money from his NIB Bank account. to Akua's Prudential Bank account.

What transactions are not covered by the E-Levy;

The following transfers are excluded from the levy:

1. Cumulative transfers of GHS 100 per day made by the same person: Everyone has a daily tax-free threshold (Limit) GHS 100- that is every person will be able to send up to GHS100 a day without the payment of the levy;

2. Transfer between accounts owned by the same person: if you are sending money to your own account (i.e., of the same person) then you will not be charged the E Levy. A transfer from Kojo's Tigo wallet to his MTN wallet or from his CBG bank account to his GCB bank account or from his savings account to his current or investment account, will not attract the levy.

3. Transfers for the payment of taxes, fees, and charges: Any payment of taxes fees or charges made to an MDA or MMDA using the Ghana.gov platform or other designated method, do not attract the levy.

4. Electronic Clearing of Cheques: Clearing of cheques by the banks and specialised deposit-taking institutions such as savings and loans companies etc. are excluded.

5. Specified merchant payments: Payments made to commercial establishments through a payment service (mobile money, bank application, Fintech etc.) to a person registered with the Ghana Revenue Authority for the purposes of income tax or value-added tax is excluded. This applies to both online and physical sales.

6. Transfers between principal, agent, and master-agent accounts: To avoid charging the levy multiple times transfers that pass through multiple service providers before they get to the actual recipient do not attract the levy.

Are utility and airtime payments subject to the E-levy?

Yes. Once the payment is made from a mobile money account, bank account, or through a merchant payment platform; and exceeds the GHS 100 daily threshold the levy is payable.

Will the levy be charged on payments of wages and salaries using mobile money?

If the company is registered with GRA for income tax or VAT and salary payment is made from a corporate bank account, there will be no e-levy charge on the amount.

Will there be a threshold above which E-levy charges will not apply?

No, there is no threshold; the E-levy applies to all transfer amounts.

No comments yet

Be the first to share your thoughts!