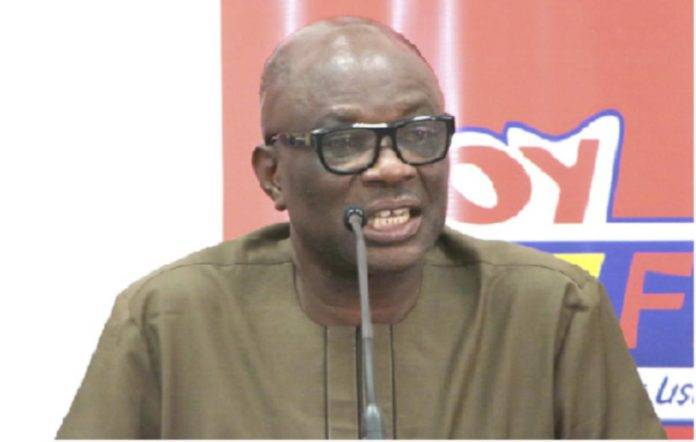

Dr. Joseph Obeng, President of the Ghana Union of Traders Association (GUTA), has echoed demands from certain Ghanaians for the government to continue to widen the tax net to include more firms in order to maintain tax justice and equity in Ghana.

According to him, despite the fact that Ghana has a population of over 30 million Ghanaians and 13 million prospective tax payers, just a small percentage of them have been enlisted to pay taxes.

According to him, this is mostly due to noncompliance and a lack of affordability on the part of individuals, corporations, and others.

"There are around 13 million prospective tax payers in Ghana, but only about 1.2 million individuals pay properly, while a large number of others do not pay," he stated.

In an interview with the DAILY GUIDE after Parliament passed the E-Levy last Thursday, he stated that while the E-levy was a component of a tax system, it would allow for a far larger number of individuals to be included in the tax regime, hence increasing government income for the economy.

Prior to its approval, the bill placed a 1.7 percent tax on all electronic transactions and money transfers, but the rate was cut to 1.5 percent.

He said that the ongoing tax burden on a small number of enterprises is due to the tax system's failure to identify businesses that do not have physical addresses, therefore the government's attempt to broaden the tax net is good.

"Once the tax net is widened, it will relieve pressure on imports, dealers, and corporate institutions that were already paying tax," he said. "However, any method that provides innovation for the tax net to be widened, we are all for it," he said.

Dr. Obeng also urged the government to invest in rigorous education to explain the payment procedures, considering the nature of some dealers' enterprises.

"People are worrying about duplication of payment," he said, "how can the system ensure that people and companies are not debited twice?" Any tax system that provides innovation for the benefit of all should guarantee fairness, parity, and affordability in order to be accepted by all, any system that delivers innovation for the benefit of all should ensure fairness, parity, and affordability in order to be accepted by all.