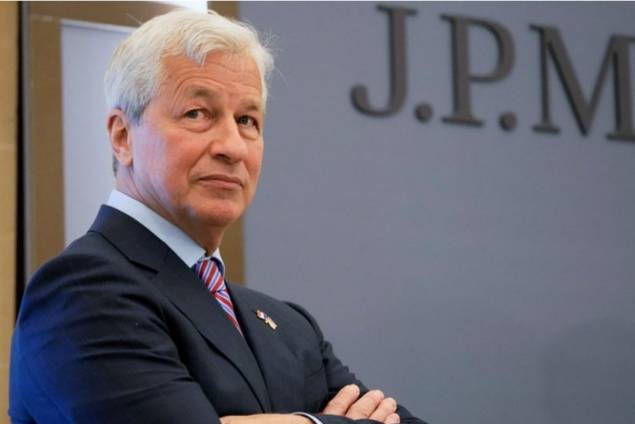

JPMorgan chief, Jamie Dimon cautioned on Monday that the bank could lose about $1 billion on its Russia openness, whenever it first has itemized the degree of its potential misfortunes coming about because of the contention in Ukraine.

In his definitely watched yearly letter to investors, the administrator and CEO of the greatest U.S. bank by resources additionally asked the United States to build its tactical presence in Europe and repeated a call for it to foster an arrangement to guarantee energy security for itself as well as its partners.

Dimon didn't give subtleties on JPMorgan's potential misfortune number or a time period however said the bank was worried about the auxiliary effect of Russia's intrusion of Ukraine on organizations and nations. Russia considers its activities a "extraordinary activity."

Worldwide banks have itemized their openness to Russia lately however Dimon is the most high-profile world business pioneer yet to remark on the more extensive effect of the contention.

"America should be prepared for the chance of a lengthy conflict in Ukraine with unusual results. We ought to plan for the most awful and remain optimistic," he composed.

Dimon tended to the connection between the United States and China and said the United States ought to patch up its inventory network to confine its degree to providers inside the United States or to incorporate "totally cordial partners as it were".

He encouraged the United States to rejoin the Trans-Pacific Partnership (TPP), one of the world's greatest worldwide economic agreements.

Remarking on the macroeconomic climate, Dimon said the quantity of Federal Reserve loan cost climbs "could be essentially higher than the market anticipates."

He additionally itemized the bank's increasing costs, to some extent because of innovation ventures and obtaining costs.

The letter is Dimon's seventeenth as CEO. While Dimon isn't the main CEO of a top U.S. bank to compose such letters, his have become must-peruses among Wall Street's first class and policymakers for the view they give into his political and monetary thoughts.

'Fort BALANCE SHEET'

The current year's letter comes as the Russia-Ukraine war and high expansion are harming the economy, and as Dimon faces new wariness from financial backers over costs.

Some inquiry his arrangements to increment spending on the bank's data innovation and missions to take portion of the overall industry in organizations and geologies where JPMorgan presently trails contenders, for example, in Germany and the United Kingdom.

JPMorgan chose recently to hold its first financial backer day since the pandemic started to address questions about its spending plans. The gathering will be hung on May 23.

Dimon has gone through over 10 years building what he refers to the bank's as' "fortification asset report," and he said it is currently powerful enough that JPMorgan could endure misfortunes of $10 at least billion and "still be looking excellent."

While Dimon composed that he isn't stressed over the bank's openness to Russia, he said the conflict in Ukraine will slow the worldwide economy and will affect international affairs for a really long time.

"We are confronting difficulties every step of the way: a pandemic, extraordinary government activities, a solid recuperation after a sharp and profound worldwide downturn, an exceptionally spellbound U.S. political decision, mounting expansion, a conflict in Ukraine and sensational financial assents against Russia," he said.

On acquisitions, Dimon said that the bank will lessen stock buybacks throughout the following year to meet capital increments expected by government rules "and in light of the fact that we have made a few decent acquisitions that we accept will upgrade the fate of our organization."

JPMorgan has been on a purchasing binge, spending almost $5 billion on acquisitions throughout recent months. Dimon said that will increment "steady venture costs" by generally $700 million this year.

Dimon said that interests in innovation will add $2 billion to costs this year.

No comments yet

Be the first to share your thoughts!