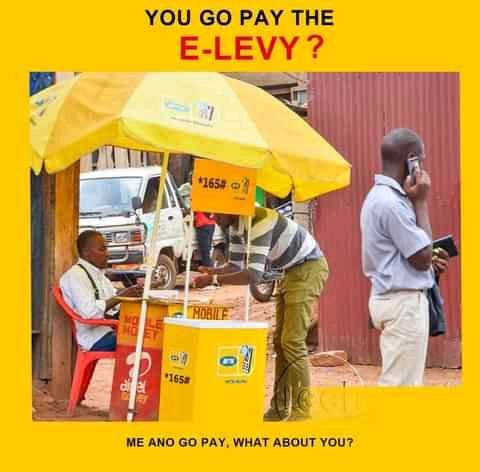

The controversial 1.50% levy on electronic transactions since it's approval has become the headache of many Ghanaians.

Many have become apprehensive about how the new tax will badly affect their finances and businesses pending it's full implementation in May. An expected ¢4.9bn is to be collected by the Ghana Revenue Authority.

Pending the implementation, these are six(6) simple ways to evade the tax.

• Chase the cheque book: Clearing the cheque book by electronic means is exempted from the fee. It provides an optional avenue to reduce risk of exposure especially with the current security challenges.

• Do physical cash-in and cash-out: Taxes doesn't cover cash-in and cash-out. That is an optional opportunity, but you should be minded by the dangers of cashing out.

• Payment through merchant codes: Paying for goods and services through the merchant codes registered with the Ghana Revenue Authority for purposes of paying VAT and income tax is one best option. You visit a shop and after buying, you ask whether the vendor is a registered GRA shop then you initiate the process of payment through that method.

• Register two numbers with the same details and give it to your parents, wife or anybody you usually send huge sums of money to.

• Update Bank, Momo account details with Ghana card: Those exempted from the levy are bank and Momo accounts of the same identity card. Updating your accounts with your Ghana card helps you evade the tax.

• Payment of taxes and fees of government through the Ghana.gov platform.

No comments yet

Be the first to share your thoughts!