Ghanaians and other users of electronic payment networks will begin paying a 1.5% fee on Sunday, May 1.

On transactions totaling more than GHS100 per day, there is a 50% tax.

Mobile Money (MoMo) payments, bank transfers, merchant payments, and inward remittances will all be subject to fees at the moment of transfer.

The implementation of Ghana's newly introduced revenue generation mechanism, the Electronic Transfer Levy Act, 2022 (Act 1075), received presidential assent on March 31 after it was passed by Parliament on Tuesday, March 29, despite the Minority side staging a walkout.

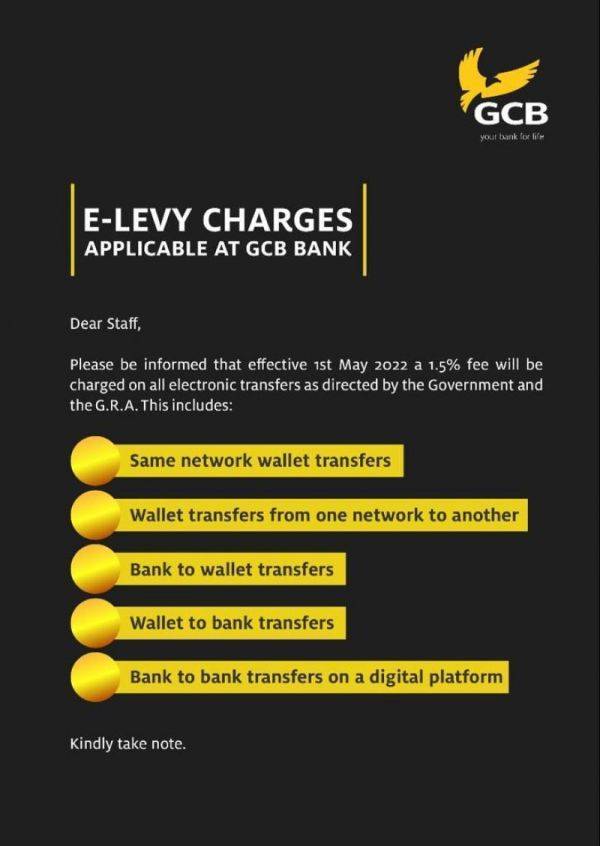

Customers have been receiving statements from banks such as Fidelity, OmniBSIC, and GCB, stating that the 1.50 levy would be applied immediately beginning Sunday.

"Dear valued customer, from May 1, 2022, E-Levy will apply to instant electronic transactions," Fidelity Bank wrote in a statement to clients on Friday, April 29.

"Dear valued customer, please be advised that effective May 1, 2022, the E-Levy will be charged on electronic transfers," OmniBSIC added.

The decision was made to increase revenue mobilization by increasing the tax base and expanding the tax net to encompass a huge section of the population that is now untaxed, according to the government.

It will also assist Ghana in increasing its tax-to-GDP ratio from 12.5 percent in 2021 to 20 percent by 2024.

By the end of the 2022 fiscal year, the E-Levy is estimated to have generated GHS6.9 billion in income for the country. The government has said that profits from the E-Levy would be utilized to address issues such as high young unemployment, digital infrastructure and cyber security, road infrastructure, and entrepreneurship (particularly, the YouStart initiative).

The charge would be levied on the value (amount) of transfers exceeding GHS100 on a daily basis per individual, according to Ghana Revenue Authority (GRA), the country's revenue collecting and implementation agency.

The E-Levy would be implemented after a total transfer of GHS100 per day.

This includes transactions made between wallets on the same electronic money issuer using Mobile Money (MoMo).

The charge would be levied in this situation if an individual sent money from an MTN MoMo wallet to another person's MTN MoMo wallet in excess of the GHS100 per day level.

The charge would apply to transactions from one electronic money issuer's wallet to a recipient on another electronic money issuer's wallet. Sending money from your MTN MoMo wallet to someone else's AirtelTigo cash wallet, for example.

Transfers from bank accounts to mobile money accounts will also be subject to the fee, as will transfers from mobile money accounts to bank accounts.

Transactions that are not subject to the levy

The fee, on the other hand, does not apply to a daily cumulative transfer of GHS100 made by the same person.

The charge does not apply to transfers between accounts held by the same individual, such as transfers from Kojo's Tigo wallet to his MTN wallet, or from his CBG bank account to his GCB bank account, or from his savings account to his current or investment account.

Payments made to Ministries, Departments, and Agencies (MDA) or Metropolitan, Municipal, and District Assemblies (MMDA) via the Ghana.gov platform or any other Government of Ghana recognized payment method will not be subject to the levy.

Apart from that, the tax will not apply to the clearance of checks by banks or specialized deposit-taking institutions (SDIs) such as savings and loans firms.