Dear readers, greetings! Thank you for taking the time to read this article. I am always ready to keep you informed on the most recent and exciting news from around the world.

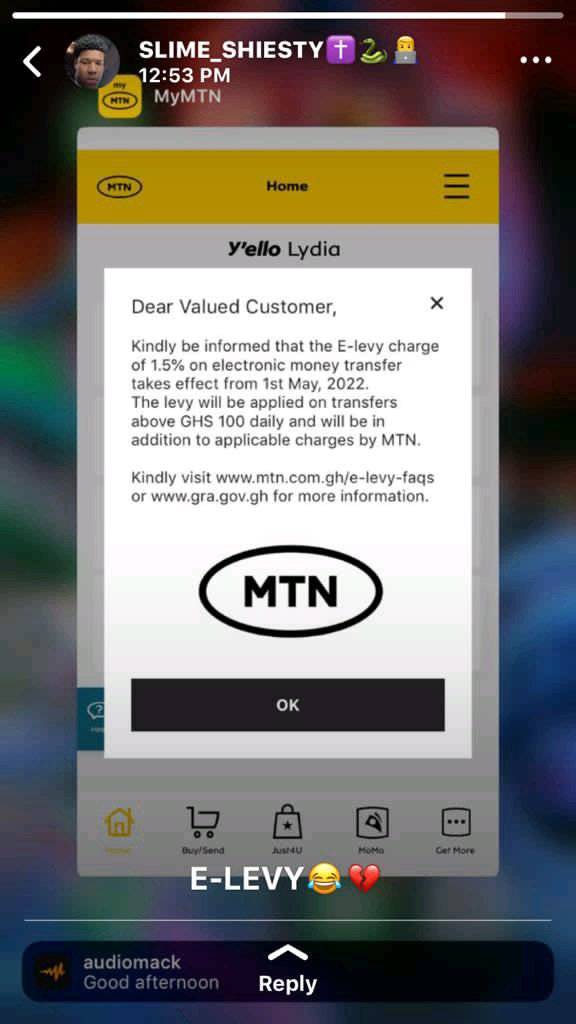

The Electronic Transaction Levy (also known as the E-levy) is a tax levied on transactions conducted over electronic or digital platforms.Ghana's Finance Minister, Ken Ofori Atta, said this during the presentation of the budget for the year 2022 on Wednesday, November 17. The fee applies to all electronic transactions, including Mobile Money, bank transfers and other remittances, as well as merchant payments, according to him. The Covid-19 pandemic threw the Ghanaian government's tax predictions into disarray in 2020. The public debt has risen dramatically as a result of the government's various social initiatives.

In Ghana, the use of mobile money has expanded at an exponential rate during the last ten years. This places the oil-producing West African country among Africa's top innovators, adopters, and users of mobile money.Mobile money accounts now outnumber bank accounts, according to the Bank of Ghana (BoG), and improved financial inclusion has helped broad swaths of the population who are still unbanked, including the poor, the young, and women.

While traditional banking services remain a distant dream for most Ghanaians, the widespread availability of mobile phones has enabled millions of Ghanaians to use mobile money services.According to Dr. Ernest Addison, Governor of the Bank of Ghana, there are currently over nineteen million (19,000,000) active mobile money accounts fueling the digital financial services business.

This indicates that the majority of Ghanaians currently use mobile money to transfer and receive money within the country. Many Ghanaians, particularly businessmen and women who conduct business electronically, have benefited from the introduction of mobile money transfers.

However, as with all other transactions, the tale of the MoMo transaction cannot be told without addressing the activities of fraudsters who attempt to deceive users, as well as the countermeasures implemented.

At least half of all Mobile Money users in the country have been victimized by fraudsters in some fashion.They used a variety of methods to empty the accounts of select Momo users while avoiding detection by the communications network providers.

They constantly changing their methods of luring individuals into their trap day after day.

The new method that fraudsters are using to gain access to your Momo account.

Some artists are as clever as they are, and will call you on your phone claiming to work for MTN, Vodafone, or AirtelTigo and would want to assist you in protecting your money from the E-levy.

They claim that if you follow their instructions, the 1.5 percent that must be deducted from all of your Momo transactions will be lowered to 0.5 percent. They'll then ask for your information.They'll take you through a series of steps to collect your money when they get your secret PIN code.

Please don't fall for it; these are artists looking to steal your money.

I've been a victim, and I don't want you to go through what I've gone through.

No comments yet

Be the first to share your thoughts!