Vice President Mahamudu Bawumia says the government would use digitization to improve the supply of insurance services in Ghana, and he urges industry players to work together to build confidence.

He stated that the government's goal was to develop micro and agricultural insurance products in order to increase access and strengthen the insurance industry's balance sheet.

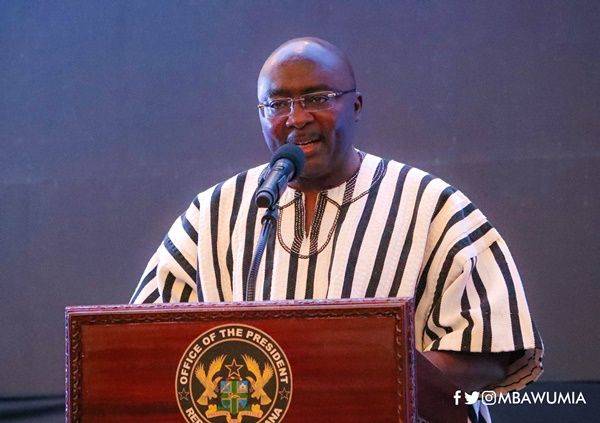

Vice President Bawumia made the remarks during the West African Insurance Companies Association (WAICAAnnual )'s General Meeting and Education Meeting in Accra on Thursday.

"The New Normal, Fact or Fiction - How Realistic in Practice and Spread of Insurance in West Africa?" was the focus of the two-day conference. It drew insurance companies and other stakeholders to talk about and deliberate on how to increase services in the face of the Covid-19 outbreak.

The Vice President urged business leaders to back the government's efforts to create a more financially inclusive society.

He claimed that the country was recovering from the effects of the COVID-19, citing figures showing a 5.4 percent growth rate last year.

According to Dr. Bawumia, such a performance would represent, on average, all of the economy's primary drivers.

He stated that the insurance business was a key emphasis in the country's development efforts and that the government would guarantee that it fed into the capital market and translated into broader economic growth. The National Insurance Commission (NIC) has created a motor insurance database as part of the government's digitalization campaign to combat the threat of automobiles with bogus motor insurance fines.

According to the Vice President, the installation of vehicle insurance led to a growth of 19% in 2020 and 26% in 2021, with the value of the business increasing from GHc566 million in 2017 to GHc2.3 billion in 2021.

He noted that there were also initiatives to link the NIC and the Driver and Vehicle Licensing Authority databases to guarantee consistency in obtaining insurance services and to clear the business of illegalities.

Dr. Bawumia praised the Association for its efforts to increase insurance coverage and penetration in West Africa. He said that the government had taken steps such as passing a new Insurance Act, which established a strict regulatory framework to safeguard consumers and enhance insurance accessible to Ghanaians, particularly the informal sector, operators, and low-income customers.

He said, "It also contains measures targeted at boosting corporate governance procedures within the sector and in conformity with worldwide best practices of the risk-based supervisory framework."

"The new Insurance Act increased the NIC's regulatory powers and provided for the regulation of maritime insurance, agricultural insurance, micro-insurance, and innovative insurance," says the report.

He said that the government has begun a recapitalization of the insurance business to assist improve the balance sheets of regulated insurance organizations, with the goal of increasing insurance underwriting capacity and allowing them to take on more risk.

It would guarantee that resources are available for important productive sectors like technology, product development, and the distribution of suitable insurance packages.

The NIC's Commissioner, Dr Justice Yaw Ofori, stated that the continuing recapitalization remained one of the NIC's most important operations.

He explained that the NIC anticipated that its adoption would pave the way for significant industrial expansion and profitability.

Dr. Ofori said that the Commission was also working closely with partner stakeholders to ensure that the different mandatory insurances were implemented.