Broker Risk

Another in the list of top forex risks is the risk associated with the forex broker or financial service provider. It is very important that traders pursue diligent research before putting in their hard-earned money with any broker in the trading world. If one goes with a wrong forex broker involved in fraudulent activities, one can end up losing all the capital and profits. Therefore, it is crucial to pursue trade with a regulated and reputable broker.

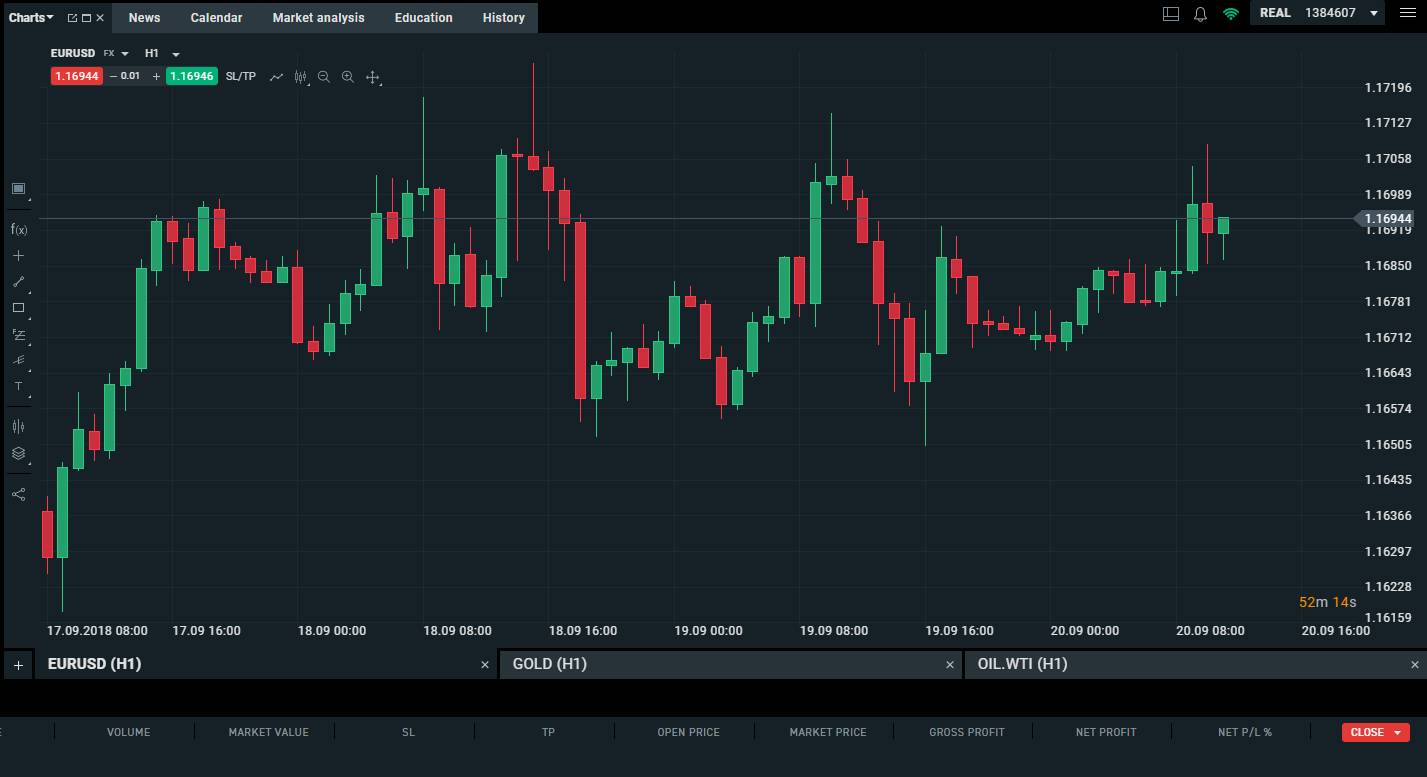

If you are looking for a financial broker to pursue forex or any other trade, we recommend HFTrading. HFTrading is a highly regulated broker offering trade in an expansive range of instruments like currency pairs, commodities, metals, stocks, indices, ETFs, CFDs, and more.

Counterparty Risk

A counterparty is any company in a foreign exchange transaction that renders the asset to the trader. Counterparty risk entails the risk from the broker or financial service provider, or dealer involved in a particular transaction. If we talk about forex trading, the forward and spot contracts are not guaranteed by any exchange. In spot trading the currencies, the risk is present in the solvency of the maker of the market. During sheer volatility, the counterparty might refuse to adhere to the contract.

Devaluation Risk

In the list of top forex risks lastly, we will shed some light on devaluation risk. Devaluation occurs when a country alters its currency downward as compared to another country's currency in utter deliberation.

Devaluation is a financial policy tool used by countries that have a fixed exchange rate. The government determines devaluation due to the impact of currency price on the activity of the government. One of the main reasons why the government devalues its currency is to stop the imbalances in trades. Devaluation of currency results in a reduction in exports of the country, making them less expensive and more competitive in the international markets.

So when devaluation occurs, interest rates are hiked up to keep inflation in control. Devaluation can be seen as a sign of weak economic conditions in a country that dismantles the creditworthiness of a country. Sometimes, devaluation is a result of utter competition in which countries devalue their currencies in response to the devaluation of neighboring country's currency. This leads to global issues in the markets. Therefore, you must put utter consideration into the countries that are devaluing their currencies.

Conclusion

With this rather long list of forex risks, the losses in the forex market may be higher during the initial times. Due to high leverages operating in the market, a small initial fee can lead to huge losses due to illiquid assets. Moreover, the time differences and political risks associated with the forex market can have lasting impacts on various currencies. Yes, the forex market has the highest trading volume, but the risks are high too.

No comments yet

Be the first to share your thoughts!