exchanging around $30,000, which is close to the lower part of an extended cost range. The digital currency has all the earmarks of being balancing out, in spite of the fact that at $33,000 and $35,000 could slow down a rise in cost.

BTC is up by 2% throughout the course of recent hours and somewhere near 24% throughout the course of recent days. The new auction expanded bitcoin's present moment downtrend regardless of oversold conditions on the outline.

The general strength file (RSI) on the everyday graph is ascending from oversold levels, came to on May 12 when BTC declined toward $25,300. Commonly, oversold signals go before a cost bob, like what happened in late January.

Further, on the everyday outline, BTC on target to enlist a forward movement signal, per the MACD marker interestingly since late March. In any case, force signals stay negative on the week after week and month to month graphs, which proposes restricted potential gain from here. U.S. stocks pushed higher Tuesday, floated by a convention in tech shares, as every one of the three records tore back from extraordinary selling last week prodded by stresses around diligent degrees of expansion and the possibility of a financial log jam.

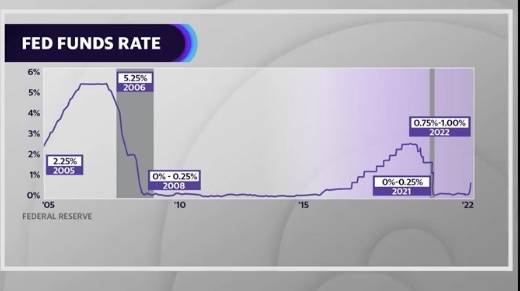

Financial backers generally disregarded hawkish comments from Federal Reserve Chair Jerome Powell at a Wall Street Journal gathering Tuesday that flagged the national bank was ready to raise rates above unbiased if necessary to get control over raised costs.

The S&P 500 acquired 2%, and the Dow Jones Industrial Average hopped 400 focuses. The tech-weighty Nasdaq Composite high level 2.8% as innovation stocks bounced back from a down meeting Monday. The moves follow six straight long stretches of declines for the S&P 500, its longest range of misfortunes in over 10 years, and seven back to back down a long time for the Dow Jones Industrial Average, the file's largest time of week after week misfortunes beginning around 2001.

No comments yet

Be the first to share your thoughts!