As midterms close, the discussion over educational loan absolution warms up: "It's like getting rebuffed for being poor"

Megan Douglas continued on from the College of Michigan in 2003 with $20,000 in instructive credit obligation.The 40-year-old mother of three took out $20,000 more to help with getting an advanced education howeverfollowing a surprisingly long time of interest when her portions proceed, she will stand up to a commitment complete that has nearly multiplied.

The whole time that you're not making with the eventual result of paying these commitments at present, you'reaccumulating interest still as it's like getting repelled for being poor," she told CBS News.Douglas is one of more than 43 million borrowers who hold more than $1.6 trillion in government student advance commitment, the second-greatest commitment held by Americans, behind agreements.

I have a fourth of my pay left to buy food, manage my child and thereafter it just becomes preposterous, life becomes illogical by then," said Douglas. President Biden has said he is looking at different decisions to pardon an obscure anyway huge proportion of government student credit obligation.The White House has recently exculpated $17 billion in government student advances and put repayments on hold for the rest of the borrowers through August.

Biden Understudy Loans

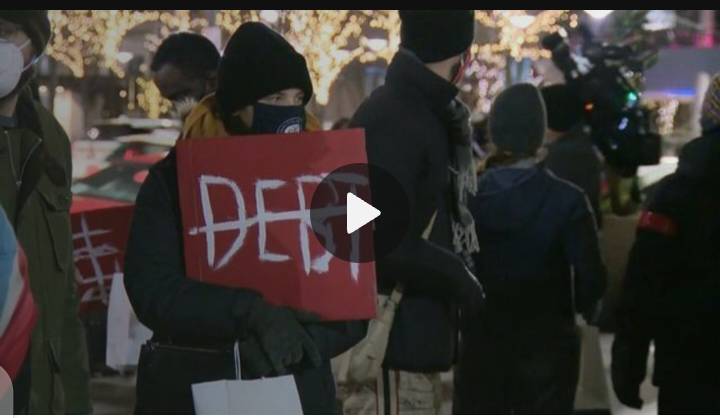

American College student Magnolia Mead sets up standards near the White House propelling student advance commitment absolution,With the run of the mill cost of a four-year advanced education moving to more than $115,000, liberals like Sen. Elizabeth Warren fight Mr.Biden can drop student advance commitment without administrative activity.

A minimal not exactly 50% of that 43 million are overseeing student loanobligation and school credit commitment on what an auxiliary school graduate makes, Warren said. That four-year school that you can make due with a parttime waitressing position, it's just not there," she added.Conservatives agree expanding costs are an issue anyway have introduced guideline impeding the president from absolving student loans.

Dropping student commitment would in like manner be terribly ridiculous to the Americans who locked in forquite quite a while to deal with their advances," Sen. John Thune said. Other moderate congresspersons in like manner question in the event that Mr.Biden can drop student advances without going through Congress as Warren had said.The Division of Training actually apparently can't arrive at a resolution.Late reviews show most Americans favor some kind of credit remission and that could factor into the association's choice.Pay based vindication may be even more legally sensible, as demonstrated by instructive credit ace Imprint Kantrowitz, yet it won't handle the central issue.Advance exoneration is a one-time eve

No comments yet

Be the first to share your thoughts!