Stocks in Asia and US prospects progressed Monday after China facilitated some infection controls and Wall Street had its greatest week since November 2020.

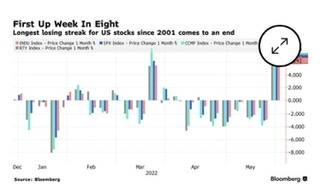

Japanese and Hong Kong values drove gains, while S&P 500 and Nasdaq 100 agreements moved in a sign the skip might have further to run. The S&P 500 cleared out its May misfortunes and snapped a line of seven week after week declines as institutional financial backers rebalanced portfolios into the month's end.

China's yuan beat after the country announced less Covid-19 cases in Beijing and Shanghai. That prodded the public authority to facilitate a portion of the severe infection controls to invigorate drooping development. Chinese stocks had more humble increases. The dollar slipped for a third day versus significant companions as safe houses lost their allure in the midst of the superior state of mind. Oil exchanged close $116 a barrel as the European Union neglected to settle on a reexamined bundle of Russian approvals. Cash Treasuries won't exchange Asia in view of the US Memorial Day occasion. Dealer are considering whether the lower part of the selloff is close as financial backers have been purchasing the plunge after one of the most horrendously terrible beginnings to the year for values. In any case, a mass of stresses stays from hawkish national banks highlighting fears of a downturn, raising food expansion from the conflict in Ukraine and China's lockdowns hindering financial action.

"We are in a bear market rally," said Mahjabeen Zaman, Citigroup Australia head of speculation subject matter experts, said on Bloomberg Television. "I think the market will be exchanging range bound attempting to sort out how before long is that downturn coming or how rapidly is expansion going down." She added that Treasury yields are set to top this year. Brokers will be focusing on the US finance numbers in the not so distant future to check the Federal Reserve's fixing way as it endeavors to get control over expansion. In the mean time, the Fed is set to begin contracting its $8.9 trillion monetary record beginning Wednesday.

Somewhere else, Asia's coal benchmark revitalized to the most noteworthy on record as India moved to get shipments, fixing supplies in the district.

Here are a few critical occasions to watch this week:

US markets shut for Memorial Day Monday

EU pioneers start a two-day extraordinary gathering in Brussels Monday with the conflict in Ukraine, guard, expansion, energy and food security on the plan

China PMI Tuesday

Euro zone CPI Tuesday

The Federal Reserve is set to begin contracting its $8.9 trillion accounting report Wednesday

The Fed delivers its Beige Book report on provincial financial circumstances Wednesday

New York Fed President John Williams, St. Louis Fed President James Bullard talk at isolated occasions Wednesday

OPEC+ virtual gathering Wednesday

Cleveland Fed President Loretta Mester examines the monetary standpoint Thursday

US May work report Friday

The UN's Food and Agriculture Organization delivers its month to month food cost file during a period of greatest worry about worldwide supplies. Friday

A portion of the principal moves in business sectors:

Stocks

S&P 500 prospects rose 0.5% as of 11:25 a.m. in Tokyo. The S&P 500 rose 2.5%

Nasdaq 100 prospects expanded 0.8%. The Nasdaq 100 rose 3.3%

Topix record climbed 1.8%

Australia's S&P/ASX 200 Index progressed 0.9%

Hang Seng Index acquired 2.1%

Shanghai Composite Index rose 0.6%

Euro Stoxx 50 fates climbed 0.6%

Monetary standards

The Bloomberg Dollar Spot Index fell 0.2%

The Japanese yen rose 0.1% to 126.97 per dollar

No comments yet

Be the first to share your thoughts!