Introduction

Inasmuch as Technology has numerous Disadvantages, its advantages have come a long way and it can’t be overlooked.

Technology has contributed immensely to the development of the World, which Africa, Ghana is no exception. One Aspect of humans’ live Technology has helped is The Financial or Banking Sector – From Automated Teller Machines(ATMs), Mobile Banking, and so forth.

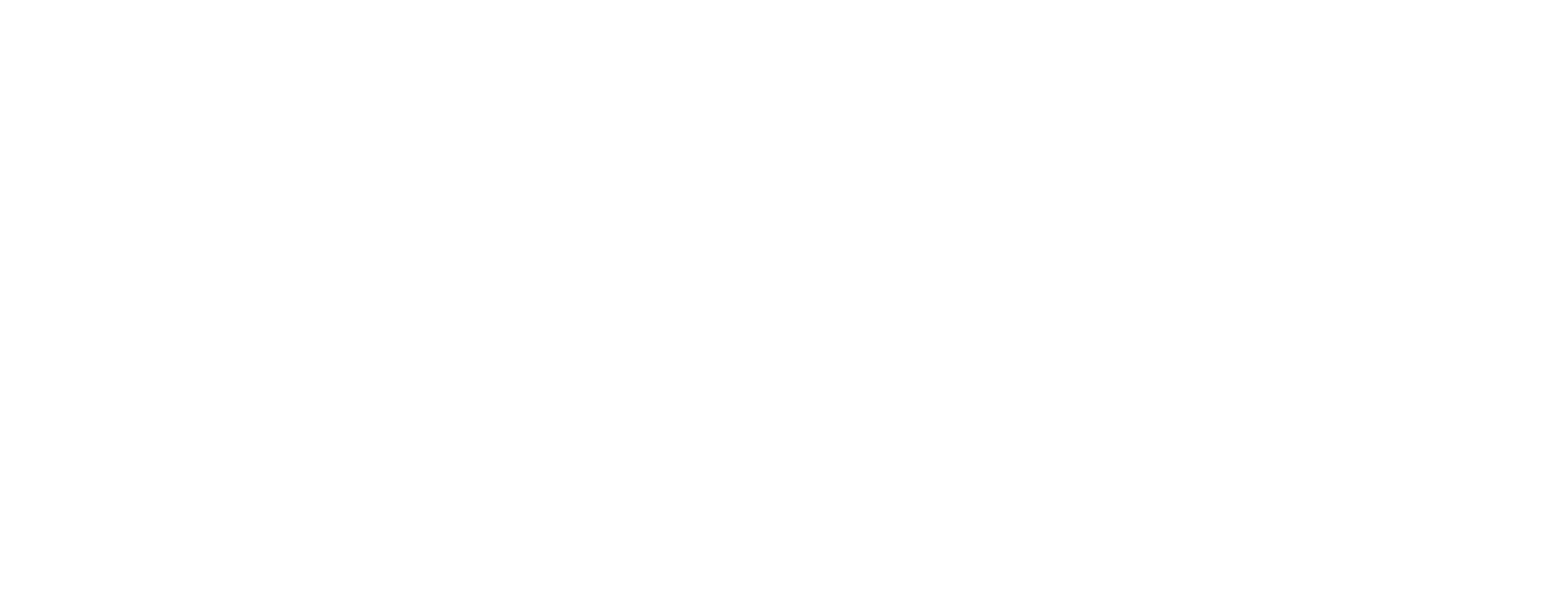

We have Witness lots of Mobile Loan Companies Emerging in Ghana, and Africa at Large. – One Fast Rising Mobile Loan In Ghana is Fido Loan.

What Is Fido Loan?

Fido Micro Credit/Fido Mobile Loan is a Licensed Financial Institution in Ghana that seeks to provide fast and easy short-term loans.

Fido Gives a Minimum of Gh¢ 200 and a Maximum of Gh¢ 1,000 Loans to New Loanees and Loyal Borrowers Respectively.

As the title of this post suggests, We Shall guide you through the process of applying for Fido’s mobile loan to get the loan almost instantly via your Mobile Money Wallet.

So, Without Further ado, Let’s Get Started!

Why choose Fido loan over the rest?

Undoubtedly, you’ve heard of plenty of mobile loan apps in Ghana, below are some major reasons why Fido is leading.

Apply on your phone; anytime, anywhere.

Apply on your phone; anytime, anywhere.

Receive a loan request decision within minutes.

Receive a loan request decision within minutes.

No hidden fees, all costs are displayed in the app.

No hidden fees, all costs are displayed in the app.

No paperwork, No waiting in bank queues.

No paperwork, No waiting in bank queues.

No collateral & No guarantor.

No collateral & No guarantor.

Money is disbursed instantly.

Money is disbursed instantly.

What do you get with Fido?

? Receive up to GHS200 for your first loan

? Your loan amount is increased every time you repay on time, up to a maximum of GHS2,000

? As the loan increases, fido decrease the interest rate and offer installment options

? Interest rate and total amount to repay are displayed in the app

What do you need to apply?

? A valid ID (New and Old Voter’s ID, Driver’s license & Passport)

? A mobile money account registered in your own name

? They accept MTN & Vodafone mobile money wallets

? Be a resident of Ghana, over 18 years of age

Dos and Don’ts of Fido Loan Application

Don’ts

?Don’t use a mobile money number that does not belong to you.

?Don’t use someone’s ID card.

?Don’t use names that are not on the ID card or shorten it (Ex. Do not write Abiba if the name on your ID is Abibatu

if the name on your ID is Abibatu )

)

?Don’t use an ID card that has spelling mistakes or the wrong date of birth. Contact your service provider to correct the error before applying again.

?Don’t apply for someone else.

Dos

?Ensure that you type your correct ID number

?Ensure that you type the mobile money number correctly

?Ensure that the date of birth you select is correct, and it’s the same as the date of birth on the ID

?Ensure that there are no mistakes with the name and date of birth on the ID card you want to use for the application

?Ensure to repay your loan on time to continue doing business with Fido

blogpay

blogpay

Total Comments: 0