Arnold Parker, the chief executive officer of Letshego Ghana, has disclosed that interest rates on Qwikloans would rise in the upcoming weeks as money market interest rates rise.

Qwikloan, an innovative financial service offered by Letshego Ghana and MTN Mobile Money (MoMo), gives MTN Mobile Money subscribers—a total of 42 million as of this writing—short-term, unsecured, rapid, and simple loans.

updating stakeholders during the Fact, including investors "If not for some measures we have taken, what would have happened is that not only would margins have shrunk, but our interest expense would have been more than interest income; because as of right now, the Treasury bill," said Mr. Parker, speaking behind the figures presented at the Ghana Stock Exchange (GSE).

A 30-day Qwik loan now has an interest rate of 6.8%. However, lenders impose a 12.5% fee on borrowers who fall behind on their payments.

As of June 20, 2022, Treasury rates have risen from 12.52 percent in early January 2022 to 24.68 percent.

The CEO stated, "Unfortunately for our consumers, we have to immediately alter our tariffs.

Mr. Parker further said that there are around 42 million loans. We disburse an average of GH10 million in loans every day, according to the statement. That works up to about Gh300 million every month. Technically, that equals GH2.6 billion annually.

Therefore, working with our partners Jumo and MTN has been a great learning experience. We have learned a lot about customer behaviour, repayment behaviour, and how to plan loans and repayments so that collections remain as high as possible.

So, it's still in construction. There is still a great deal to be done in that area. And hopefully, we'll pay more attention to that in the years to come," the CEO said.

He said that the Ghana Card and the E-levy have had a minor impact on loan intake.

In order to avoid the E-levy fees, the majority of mobile money users have decreased the amount of dollars stored in their mobile wallets. Customers' loan eligibility has decreased as a result of this.

He is certain, though, that customers will learn about the exceptions and return to the platform once they do.

"I'm sure they'll ultimately realise there are many exclusions, and then they could come back. We have seen that they are now also eligible for reduced sums as a result of not using their wallets frequently. These are the lessons learned, he added, and we must immediately rewrite our algorithms to account for them.

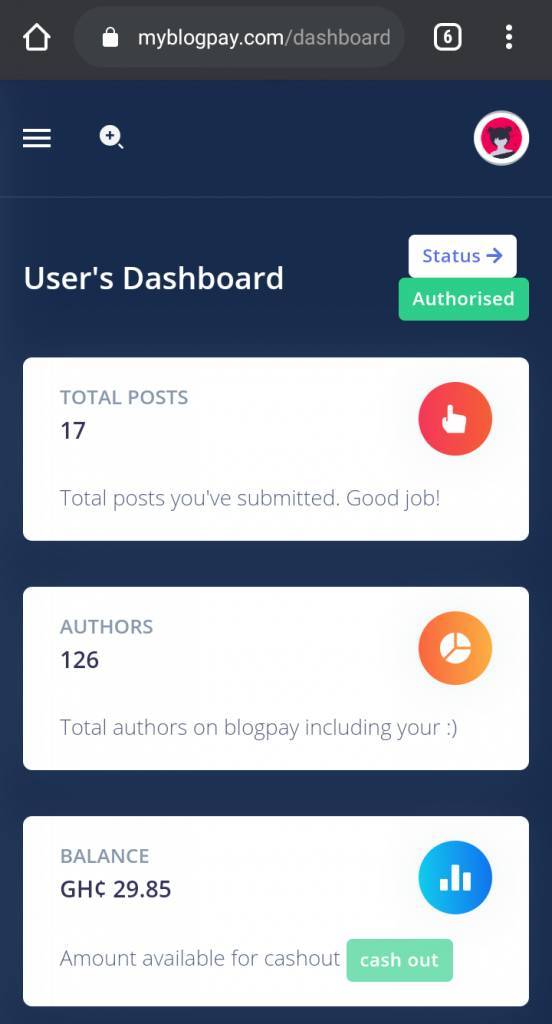

blogpay

blogpay