Varied people have different definitions of financial freedom. Making ends meet without help from others, according to some.

Some people think it's taking care of today's financial commitments while conserving money for a comfortable retirement.

However, it is important to remember that in order to attain actual financial independence, both are required.

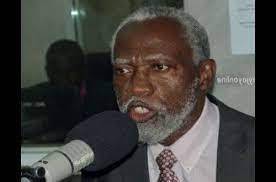

Professor Emeritus Stephen Adei provided 13 useful financial independence tips this week on Springboard Your Virtual University. These tips can help a typical paid worker amass a million dollars in assets and avoid retiring penniless.

He emphasised that one may become wealthy without turning to dishonest means or engaging in corruption.

unnecessarily poor

Many individuals in the country, according to Prof. Adei, are needlessly impoverished, and those who are considered to be wealthy often acquired their wealth in the wrong ways, particularly via corruption.

He said, "It should be possible to be affluent and holy."

He pointed up two verses in the Bible that appear to be in conflict yet are not.

These two verses are Deuteronomy 15:4 and Matthew 26:11, which both claim that "there shall be no poor among you" and "the poor you will always have with you," respectively.

"According to how I interpret these two verses, God has provided for every person he has created in this world, but because of sin, oppression, and sloth, among other things, there will always be the poor among us.

He said, "God wants us to be prosperous, but we also have a duty to play.

mental attitude

Prof. Adei made the observation that many people's mental orientations contributed to their poverty. "People almost think and act in a way that condemns them to poverty because of our mental orientation and educational system.

"We haven't given folks chances or supported them along the way. We have not had a mechanism that enables us to assist the underprivileged, he said.

He said that many individuals expected their employers to make them wealthy, which was impossible.Less than 5% of individuals will work and earn enough money to live comfortably. The other factors are related to how they handle the money that is given to them. The ordinary individual simply has to save GHC 100 each month, and if they invest it in a typical mutual fund and receive a return of 17.5%, they would become millionaires in 30 years, he claimed.

The following are Prof. Adei's 13 guidelines towards financial freedom:

1. Financial vision. You must have a financial vision of what you want to accomplish financially during the next 10, 15, or 20 years. To persevere through problems in the near term, you need that vision.

2. Set time-bound financial goals that correspond to your vision. You must establish realistic, time-bound financial goals.

3. Investment advice; Follow the 10-10-80 rule while saving and investing. Pay 10% to God, 10% to yourself, and 80% toward your debts, according to the pious.

4. Consumer debt; stay away from it at all costs.

5. Interest-earning; Don't let your money work for your bankers or other money-grabbers. Your money should work for you. We frequently place our money in current and savings accounts, but that is not the greatest option.

6. Investment vehicles; Put money to work in places like mutual funds and provident funds where it may grow relatively risk-free.

7. Build up your wealth gradually. Only two people, criminals and corrupt individuals, swiftly get wealthy. The ordinary individual needs time to allow their savings and assets to increase.

8. Unreliable interest income; stay away from anyone who promises you returns that are twice as high as those on 90-day T-bills. The maximum return on a smart, secure investment is two times the yield on a 90-day T-bill.

9. Preventing setbacks; Make a will, purchase some modest life insurance, and build up an emergency fund to guard against unforeseen financial reversals.

10. Patient development; Have patience and allow the power of compound interest, time, consistent investment, and solid returns work for you.

11. Keep costs low; keep the cost of financial achievement low. Gaining wealth at the price of one's moral character, a fulfilling marriage, a happy family, and friendships just makes one a hypocrite.

12. Get started right away; begin a financial strategy. The greatest day to start investing was yesterday, followed by today and tomorrow as the worst days.

13. Trust in God; it is ineffective for a man to obtain the whole world while forfeiting his eternal life. In the end, God will reward your efforts with favour and success.

No comments yet

Be the first to share your thoughts!