In virtually every form of business out there, key person assurance will be an essential part of it. key man insurance UK

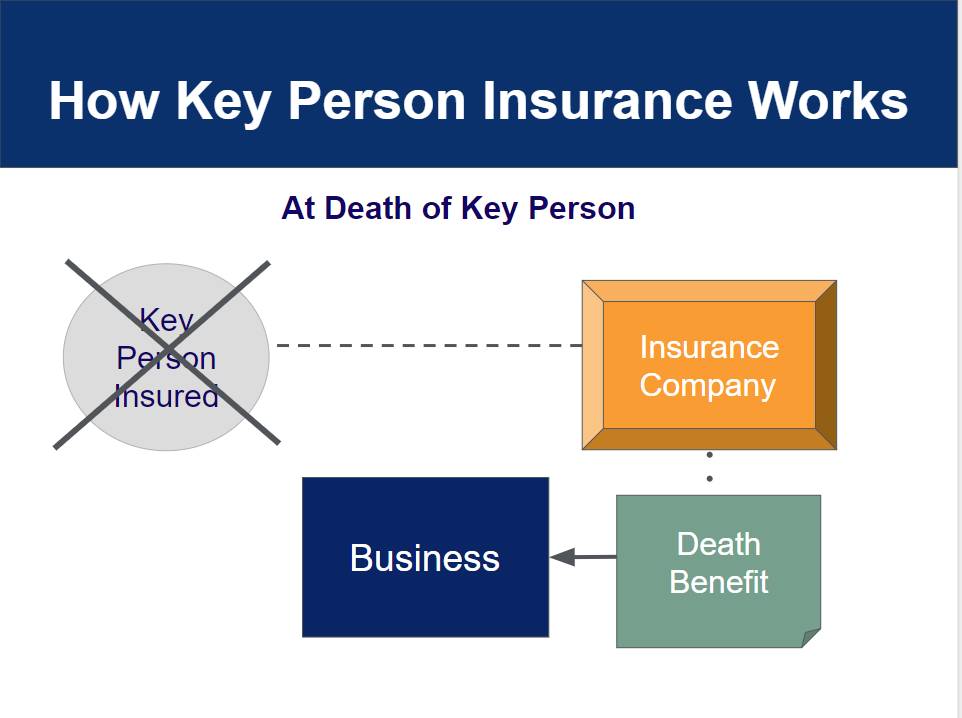

Although it does not come with any legal meaning, this type of insurance is being used to describe a policy that companies and businesses can make use of in order to protect themselves, especially in the event that the key person becomes incapable to work, ill or deceased. If a person's useful functions have depleted in any way at all, the assurance will provide benefits towards the business.

The aim of this assurance policy is to be able to recompense the business in the event there's any loss sustained because of the absence of a director, investor or perhaps staff member. It's also useful for making certain the business continues to move onward even after the key man becomes unfit to be serving the company.

Key man or perhaps key person insurance plans are usually utilized in case there are essential people in the company and a protection plan is necessary to protect their position if they're no longer around or becomes incapable.

Many companies generally take out the policy on the well being or life of a particular employee. Organisations usually do that if and when that person's expertise, general contribution and line of work are incredibly valuable to the business. These kinds of life insurance plans are helpful in offsetting the cost necessary when the key person in the company or perhaps business is lost.

As an example, getting a short-term worker or perhaps trying to find a recruit for the business can be very expensive. Apart from that, the organization may also incur losses at this time, particularly if the organization fails to function properly because of the loss of the particular key person.

It is for this reason that key person assurance is so very important when it comes to the success of a business. Without this insurance policy, the corporation could be left with no apparent directions or even understanding of exactly what should be done when the key man or key individual is no longer within the business. In relation to a business, there are lots of key persons including the owner, CEOs, managers and also shareholders.

In order to keep the company operating in case of an unfortunate event, this assurance policy comes into play.

Key person life insurance will help protect not merely the business but also the employees. It could provide the company with a completely new foundation and plan in case things don't go according to plan.

The actual insurable loses that can be covered by this particular insurance policy include losses in case the business or business needs to hire short-term help to cover for the absence of the key person and losses due to cancellations or even delays of projects handled by the key individual. key man insurance UK

If there are opportunities to further expand or increase the generation of profits of a business and they are lost, those too would be covered under the policy. All these can be covered by key person assurance, which is why it is beneficial for all businesses and companies, especially if the nature of the job is risky and the chance of losing a key person is high.

No comments yet

Be the first to share your thoughts!