Essentially, what this assurance policy does is that it covers the circumstances in which the key person (usually a director or major shareholder) becomes incapable as a result of his sickness, his death or various other instances. If a person's useful functions have depleted in any way at all, the life insurance will provide benefits towards the business.

The objective of this insurance plan is to be able to compensate the business enterprise in the event there's any deficit sustained because of the absence of a director, shareholder or staff member. Additionally it is useful in making sure that the company continues to move onward even if the particular key person becomes incapable of serving the company.

Key man or key person life insurance policies are generally found in case there are extremely important people in the business and a protection plan is necessary to protect its position if they're not around or becomes incapable.

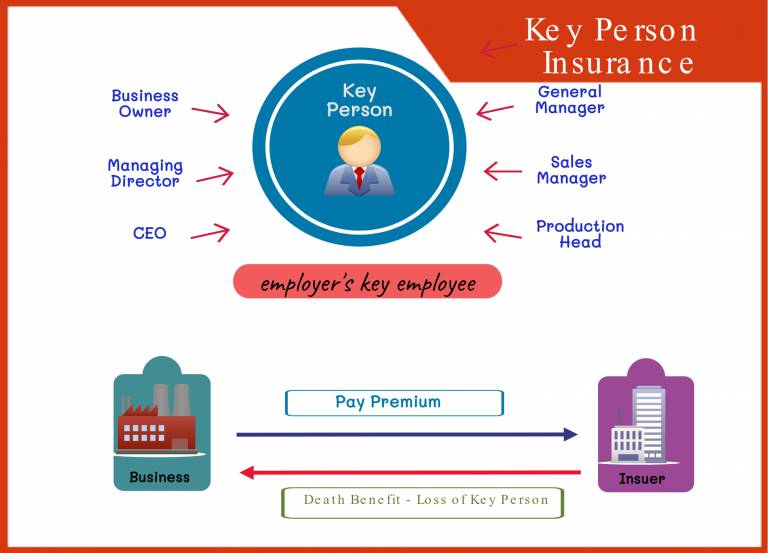

Most companies normally sign up for the insurance policy on the health or life of a specific employee. Business employers normally do this when and if that individual's expertise, general contribution and also type of work are really useful for the organization. These life insurance coverage is helpful in offsetting the cost needed when the key person in the corporation or perhaps business is lost.

By way of example, employing a short-term staff member or searching for a recruit for the organization can be extremely expensive. Apart from that, the business enterprise may also incur losses at this time, specifically if the company fails to function effectively as a result of the loss of the particular key individual.

It is for this reason that key man assurance is of utmost importance when it comes to the success of a business. Without assurance policy, the corporation could be left with no obvious directions or understanding of precisely what should be done in case the key man or key person is no longer in the business. With regard to a business, there are lots of key persons like the owner, CEOs, managers and also shareholders.

To keep the business operating in case of an unfortunate event, this particular insurance policy comes into play.

Key man insurance may help protect not only the business but also the employees. It can provide the enterprise with a whole new foundation and plan in the event things do not go according to plan. The actual insurable loses which can be covered by this life insurance policy include losses in case the business or perhaps business has to hire short-term help to replace the absence of the key man and losses due to cancellations or even delays of projects managed by the key person. key person life insurance

Besides loss of individual capabilities, this particular type of life insurance covers loss of business opportunities as well, for instance, the opportunity to generate further profits, expansion or loss of unique skills and knowledge. Almost all circumstances whereby there will potentially be a loss in contribution of a key person will be given coverage, more so if the job has a risky aspect to it and the loss of that individual would be especially devastating.

No comments yet

Be the first to share your thoughts!