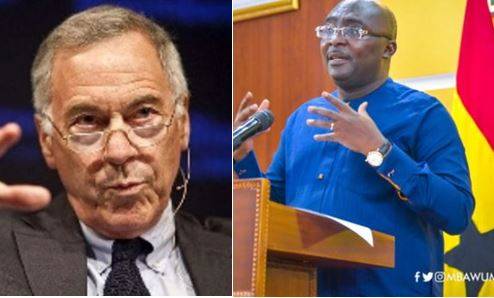

Vice President Dr. Mahamudu Bawumia is the root of the nation's troubles, according to Johns Hopkins University professor of applied economics Steve Hanke.

He asserts that despite the Vice President's stated intention to address the nation's problems, he is doing the reverse by causing more of them.

Professor Hanke's statement is in response to the Ghana Cedi's decline in value versus major trading currencies, particularly the US dollar.

The vice president of Ghana, Bawumia, claims he entered politics to aid in problem-solving. SPOILER: Bawumia is the one who is causing the issues. On September 20, he tweeted, "Today, I measure GHA's inflation at a shocking 81% per year, nearly 2.5 times the official rate."

In a different tweet, Professor Hanke, who has shown a deep interest in Ghana's economic problems, claimed that the country's economy was "tanking," which is a phrase that denotes a downturn and signs of an impending recession.

He has in the past charged that the Akufo-Addo-led government is too responsible for the dismal state of the economy.

"Ghana is ranked eighth in this week's table of inflation. On September 8, I calculated Ghana's annual inflation rate to be a startling 81%—more than twice the official rate of 34%. The economy of Ghana is tanking. On September 19, he tweeted, "GHA must set up a currency board to control inflation."

"As of right now, the annual rate of inflation in Ghana is 81%. Ghanaians are no longer aware of the cost of anything. Prof. Hanke continued, "Ghanaians can thank President Akufo-Addo when they notice a spike in their shopping expenditures.

The government claims that the effects of the COVID-19 epidemic, the ongoing Russia-Ukraine conflict, and the financial sector clean-up have severely hurt Ghana's economy.

Living standards have risen, inflation has reached record levels, and rating agencies like S&P and Fitch have downgraded the economy as a result. This has made it difficult for the government to access the global financial market.

Additionally, the Cedi has been falling precipitously, forcing the Bank of Ghana to respond to the situation by raising its monetary policy rate.

The government first contacted the International Monetary Fund for an economic support program in July as a result of the economy's deteriorating status.

Once an agreement on a program is reached, Ghana is reportedly aiming for a sum of US$3 billion over three years from the International Monetary Fund. The latest loan request was for $2.5 billion, which was double the previous $1.5 billion goal set by the administration.

To get the funding in the first quarter of the following year, the government expects to wrap up negotiations by year's end.

No comments yet

Be the first to share your thoughts!