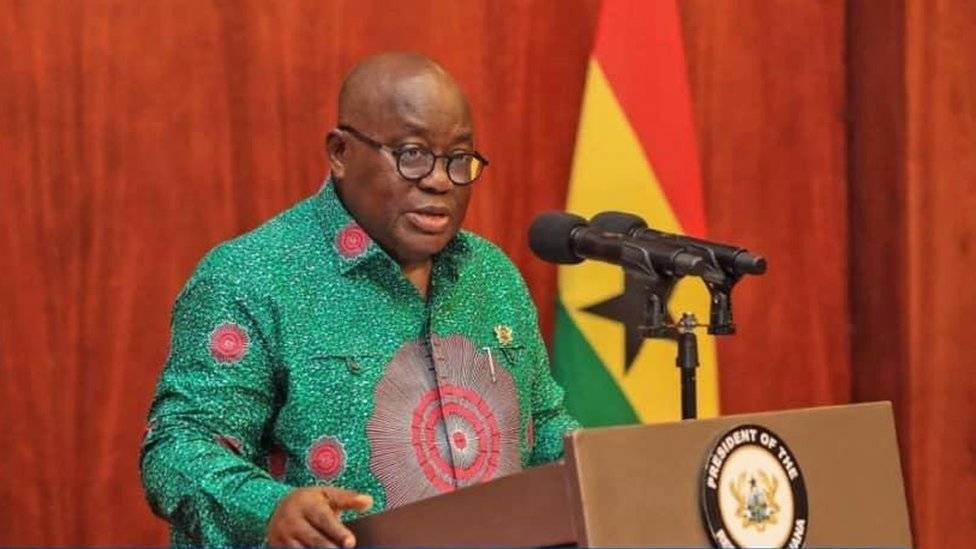

'We are in a crisis,' admits Akufo-Addo, rallying support for economic interventions.

President Nana Addo Dankwa Akufo-Addo has acknowledged that economic times are difficult and that his government is working hard to provide relief to citizens.

In an economic speech, he emphasized that his administration was ready to work toward restoring and resetting the economy on the path of progress and stability.

These were expressed in his speech to the nation on the state of the economy on October 30, 2022.

"For us in Ghana, the reality is that our economy is in serious trouble; the budget for the fiscal year 2022 has been thrown out of whack, disrupting our balance of payments and debt sustainability, and further exposing our economy's structural weaknesses."

"We are in a crisis, I do not exaggerate when I say so. I cannot find an example in history when so many malevolent forces have come together at the same time," he added.

"But, as we have shown in other circumstances, we shall turn this crisis into an opportunity to resolve not just the short-term, urgent problems, but the long-term structural problems that have bedeviled our economy.

""I implore us all to consider the decision to approach the International Monetary Fund in this light," he said.

On other issues, he kept citizens up to date on the status of IMF negotiations and efforts to stabilize the economy in the face of rapidly depreciating currency and skyrocketing inflation.

Following a three-day retreat to prepare for the address, the cabinet took the following actions:

1) The Bank of Ghana has increased its supervision of the forex bureau markets and the black market in order to flush out illegal operators while also ensuring that those permitted to operate legally follow market rules. Some forex bureaus' licenses have already been revoked, and this process will continue until complete order is restored.

2) New dollar inflows are providing liquidity to the foreign exchange market and addressing pipeline demand.

3) The Bank of Ghana has given its full commitment to commercial banks to provide liquidity to ensure the economy's wheels remain stable until the IMF Program kicks in and the financing assurances expected from other partners arrive;

4) The government is collaborating with the Bank of Ghana and oil and mining companies to develop a new legal and regulatory framework to ensure that all foreign exchange earned in Ghana is initially paid to Ghanaian banks to help boost the domestic foreign exchange market; and

5) the Bank of Ghana will enhance its gold purchase programme.

No comments yet

Be the first to share your thoughts!