How To Take 4 Different Loans At The Same Time

Teaser: Do you know taking a new separate loan is better than accessing top-up loans? At least the applicant gets to avoid paying multiple insurance premiums on the same loan. Also, since all the outstanding balance on the Payslip, which includes both the principal and interest to be paid, is deducted from top-up loans, it implies that applicants had paid all the interest on their previous loans though they had not kept that old loan for the entire period. Admittedly, sometimes, a small amount of money is refunded to GNAT loan top-up applicants but not enough to be assumed as not paying the interest on the previous loans. Admittedly also, commercial financial institutions request payment of only the principal components of any outstanding balance and rather charge a fee for early settlements or even waive that fee based on elapsed duration before early settlement.

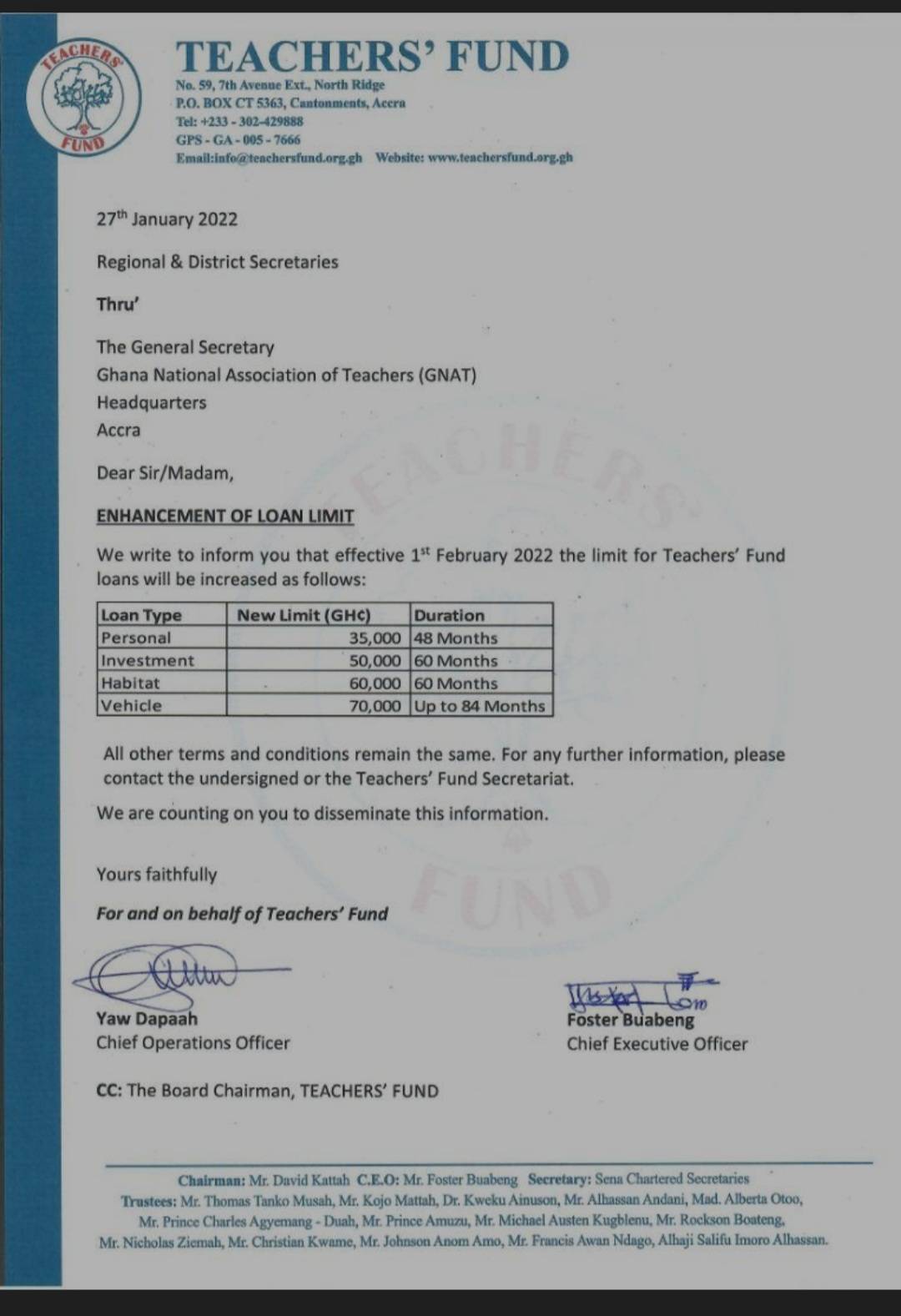

GNAT mutual fund advertises four different types of loans with different types of requirements that members must meet to access such loans. However, only a few members of the fund are able to access more than one (1) type of loan, which is personal loans. The four types of loan the Ghana National Association of Teachers (GNAT) mutual fund, commonly referred to as Teachers Fund, administer are personal loans, business/investment loans, habitat loans and auto/car loans.

Each of the types of loan has its own requirements, though there are general requirements that applicants must meet. For instance, an applicant must be a member of the Teachers’ fund and has repayment affordability to access any type of loans.

It is interesting to note that not many Teacher’s Fund members are aware multiple loans could be accessed differently and those multiple loans appear differently on their payslips. Knowing this could help members from taking top-up loans unnecessarily, since it is economically unwise to lose any amount of money, no matter how small.

First of all, provided an individual who is already on one (1) Teachers Fund personal loan has the repayment affordability for another loan, the individual must request a new separate loan. Teachers Fund Personal loan forms have the least level of requirements. And two different loans can be accessed with this personal loan form. Actually, based on explanation, more than two separate loans for any loan category can be taken until the individual hits the maximum threshold amount allowed for that category.

The extra information is that, after the individual has exhausted his personal loan limit with single or multiple separate loans, he/she will not be able to take a different loan using the personal loan application forms. Such forms would be returned to applicants with or without calls from the Teachers Fund headquarters. The applicant must apply for new separate loans using a different loan application form like the business/investment forms. Even with the business/investment application forms which scare people away because of the requirements like business registration documents from the Registrar General’s Department, individuals could use substituted documents, business registration documents from their district assemblies or even a letter head with short proposals.

No comments yet

Be the first to share your thoughts!