blogpay

blogpay

- Home

- Trending

-

- Category

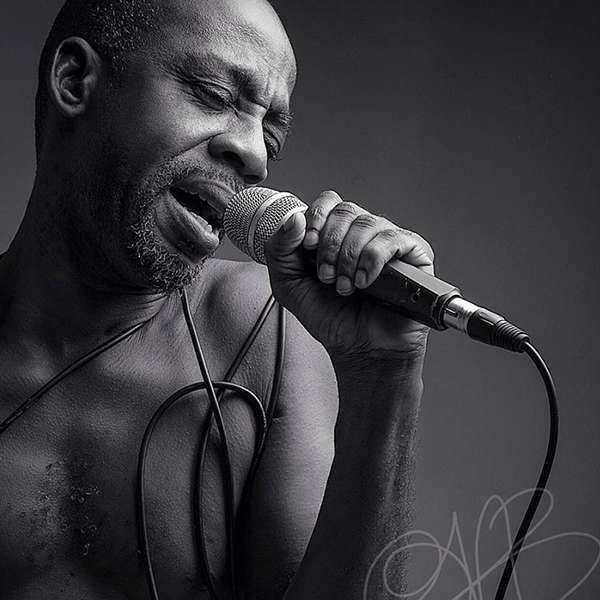

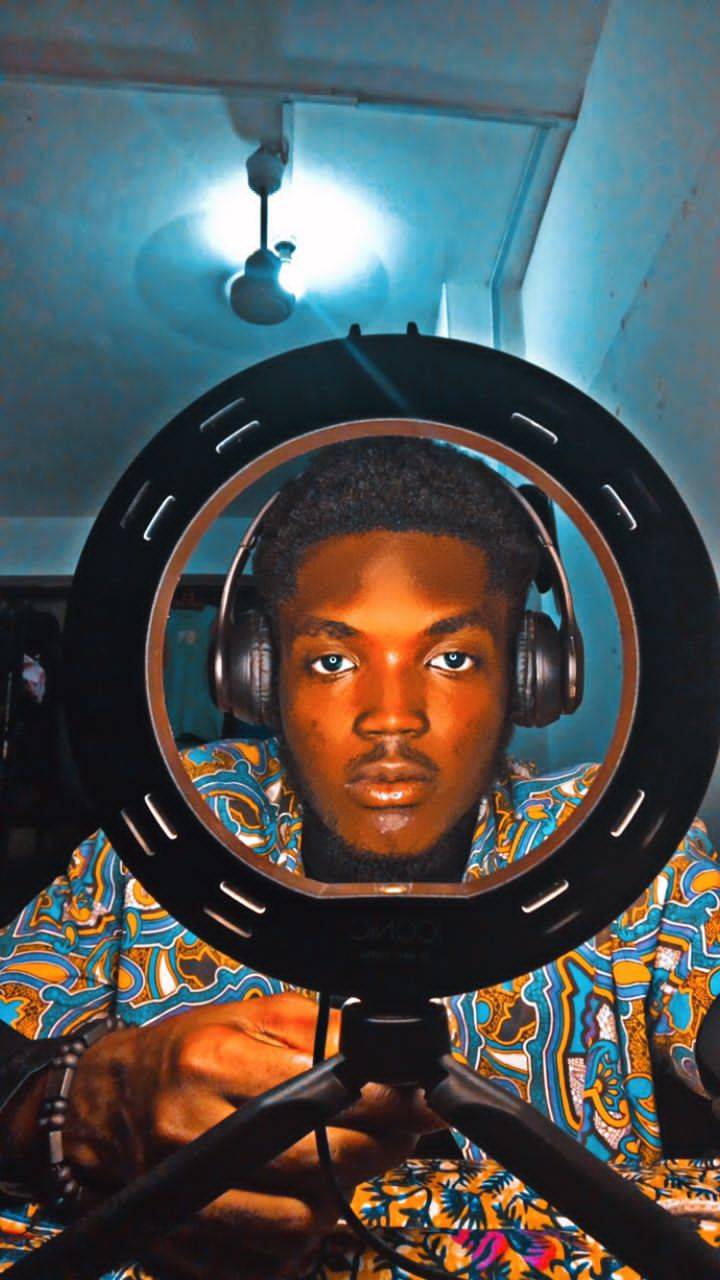

- Arts & Entertainment

- Asante Kingdom

- Autos & Vehicles

- Beauty & Fitness

- Books & Literature

- Business & Industrial

- Computers & Electronics

- Education

- Finance

- Food & Drink

- Games

- Health

- Hobbies & Leisure

- Home & Garden

- Internet & Telcom

- Jobs & Education

- Law & Government

- News

- Online Communities

- People & Society

- Pets & Animals

- Poetry

- Politics

- Real Estates

- Relationships

- Religion

- Science

- Shopping

- Sports

- Technology

- Travel

- Advertisements

Total Comments: 0